How UBA Grew Its Gross Earnings By 39.6%, Total Asset To N28.3tn —Alawuba

FUNSHO AROGUNDADE

Despite several headwinds which have created significant pressure on economies globally, the United Bank for Africa (UBA) Plc, in the first-half of 2024, delivered a strong double-digit growth across high-quality and sustainable revenue streams with a 37% growth in total assets, reaching N28.3 trillion, up from N20.7 trillion at FYE 2023.

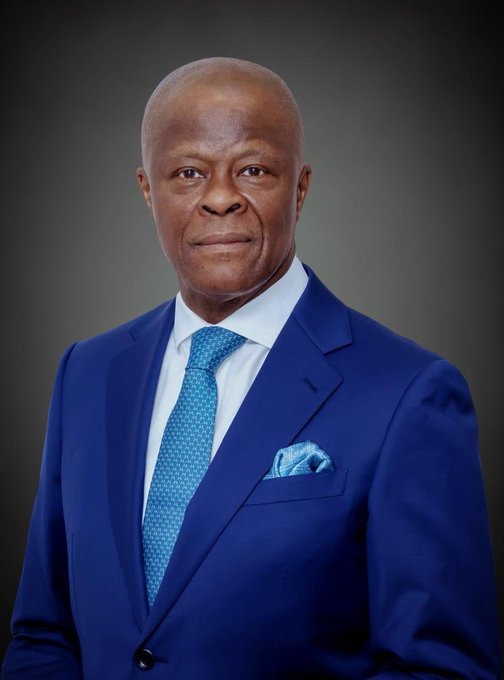

Oliver Alawuba, the Group Managing Director/Chief Executive Officer of UBA Plc disclosed this Wednesday at the Group’s Audited H1 2024 Financial Year Investors Conference in Lagos.

During the strategic review and outlook of the half year report, the UBA GMD attributed the financial performance to the lender’s commitment to delivering value and growth, disciplined execution of strategic goals, focusing on balance sheet expansion, transaction banking and digital banking businesses across its markets.

Alawuba stated that amidst the macroeconomic volatility of high inflation, rising debt levels, increasing interest rates, and tighter monetary policies, the bank managed the risks effectively to achieve a robust Profit Before Tax of N401.6 billion while customers’ deposits grew by 34%, from N17.4 trillion at year-end 2023 to N23.2 trillion in H1 2024, which demonstrated the trust and loyalty of the lender’s numerous customers.

“Our intermediation business posted impressive growth, with net interest income expanding by 143% year-on-year to N675 billion, further underlining the strength of our core banking operations. Our Digital Banking income surged by 107.8% YoY to N106 billion, while funds transfer and remittance fees rose 188.7% and 228%, respectively. We continue to lead in digital banking and payment solutions, helping drive financial inclusion across Africa. On trade facilitation, our income from trade transactions grew 83% to N18 billion as we strengthened our role in facilitating intra-regional and international trade. Our strategy of investing in technology, innovation, and data analytics continues to yield significant returns, positioning us as a leader in digital transformation,” the bank boss told the investors.

He added, “Our strong leadership, a dedicated team, supportive customers and a clear strategic direction have enabled us to achieve sustained and profitable growth. We have remained focused on navigating these challenges while upholding the ideals of Enterprise, Excellence, and Execution (3Es).”

Alawuba noted that his management team is determined to build a better bank as they continue to invest and improve in people, processes, and technology.

“We recognize that our people are our greatest asset. In 2024, we promoted over 2,000 employees and paid the 2023 bonus to eligible staff across Nigeria and UBA Africa (ex-Nigeria). On process improvements, our smart automation initiatives are simplifying service delivery. For instance, our website now offers self-service options for BVN and NIN linkage, account updates, card blocking, and more. Additionally, a comprehensive review of our procurement processes has led to significant cost optimization. Our ongoing investments in technology are enabling us to deliver superior customer experiences, drive operational efficiency, and unlock new growth opportunities,” Alawuba stated.

Strategic partnerships remain central to the Group’s growth strategy. In 2024, UBA, as one of the continent’s most influential financial institutions, was one of six banks to sign a Memorandum of Understanding with the Pan-African Payment Settlement System (PAPSS), to enhance cross-border trade and financial integration across Africa.

The bank successfully deployed the instant payment systems in five African countries, with more to follow.

Its collaborations with Telco partners have also expanded, with funds under management now exceeding $1 billion. These partnerships enable the lender to deliver impactful solutions such as micro-lending and savings products, enhancing financial inclusion.

“At UBA, we are determined to “do good” by supporting inclusivity and environmental sustainability. We have pledged to plant One Million Trees over the next one year as part of our environmental stewardship. We continue to roll out our Braille account opening packages to more countries, promoting inclusivity for visually impaired customers. Our loans to young entrepreneurs, women-led businesses, and SMEs across Africa are part of our broader commitment to driving inclusive growth,” he said.

While assuring that the bank is entering the second half of 2024 from a position of strength, Alawuba revealed that UBA Group is at the advanced stage with its recapitalization process.

“Our application has been submitted to SEC and we expect their approval in the next couple of weeks following which the market will be advised,” the bank GMD stated.

UBA Group achievements have been recognized through multiple awards, including: Global Finance’s Best Bank in Frontier Markets, Best SME Bank in Africa, Best SME Bank in Mozambique, and The African Banker’s Regional Bank of the Year for West Africa. These accolades reflect the bank’s commitment to excellence and delivering sustainable growth across our markets.