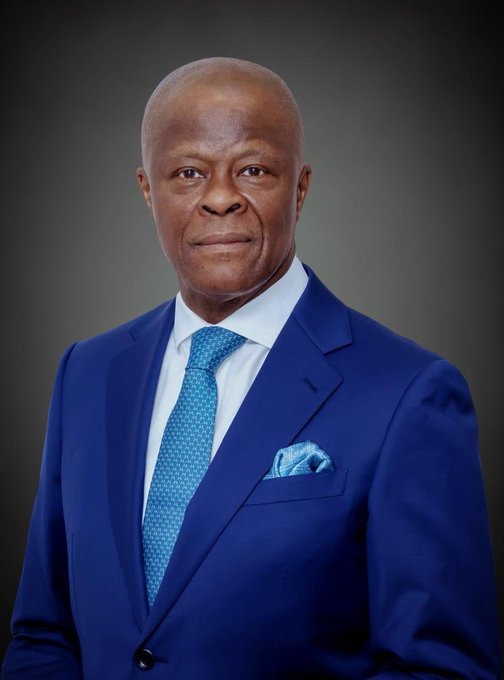

Court Orders Union Bank To Pay Jimoh Ibrahim’s NICON Investment N400bn Illegally Deducted From Account

A Lagos State High Court has voided Union Bank’s deduction of £130,720,557.06 (over N400 billion) belonging to NICON Investment Limited due to alleged indebtedness.

Justice O. O. Abike-Fadipe voided the bank’s action on the grounds that the deduction was made without authorisation or approval by NICON Investment.

The court subsequently awarded £1 million as damages against Union Bank of Nigeria Plc for breaching its fiduciary duties to NICON Investment Limited, owned by Senator Jimoh Ibrahim.

Abike-Fadipe made the order while delivering judgement in a suit filed by NICON Investment Limited, Global Fleet Oil and Gas Ltd, and Senator Ibrahim, on Thursday.

The claimant had dragged the bank to court to challenge the alleged unlawful deductions from its fixed deposit account with Union Bank, over N10 billion and N16 billion loan facilities for the operation of Global Fleet/NICON investment.

Union Bank had predicated its action on the grounds of an alleged mutual agreement between it and the claimant and its sister company, Global Fleet Oil and Gas Ltd.

Specifically, the bank argued that the fixed deposits in the accounts of the claimant as well as that of Global Fleet were given as collateral for the loans to the claimant.

As part of efforts at recovering the loans, Union Bank had converted the sum of £130,720,557.06 in the fixed deposit account of the claimant with the bank to dollars, an act which resulted to the court case wherein judgement was delivered on Thursday.

Abike-Fadipe, who dismissed reliefs 10 and 11 of the claimant, held that “Judgement is entered for the claimant against the defendant on the claimant’s reliefs 1 to 9 and 12 to 17”.

She accordingly declared as null and void the “defendant bank’s unilateral act of converting the sum of £130,720,557.06 (one hundred and thirty million, seven hundred and twenty thousand, five hundred and fifty-seven pounds and six pence) from the claimant’s fixed deposit account to US dollars without the due authorisation and/or mandate of the claimant”.

According to the court, the pounds sterling fixed deposit account of the claimant was not tied to the indebtedness of Global Fleet Ltd and/or meant in any way or manner whatsoever to provide security for the said debt.

The court further held that the defendant bank’s unilateral use of part of the sum of £130,720,557.06 to liquidate Global Fleet Ltd debt without the mandate and/or due authorisation of the claimant was wrongful, null and void.

The court held, “The indebtedness of Global Fleet Ltd to the Defendant (if any) is neither payable from the £130,720,557.06 fixed deposit of the claimant nor is any amount deductible therefrom in respect of Global Fleet Ltd indebtedness.

“The defendant bank cannot unilaterally deal with or make any deduction from the fixed deposit account of the claimant without the authorisation, mandate or consent of the signatories to the fixed deposit account as on the mandate card.”

The court subsequently awarded the sum of N50 million to the claimant against the defendant as damages for unlawful deduction and illegal penalties and charges made on the account of the claimant by the defendant.

It said, “The defendant is directed to render an account of all the transactions on the claimant’s pound sterling fixed deposit account together with all accrued interests thereon.

“An order setting aside all acts of the defendant pertaining to and/or connected with and affecting the claimant’s pounds sterling fixed deposit account vis-s-viz its conversion to US Dollars, Naira and unilateral liquidation of the indebtedness of Global Fleet Ltd and NICON Investment Limited from the said account.

“The sum of £1,000,000:00 (One Million Pounds Sterling) as damages for the defendant’s breach of its fiduciary duties to the claimant and negligence.”

The court dismissed in its entirety the defendant’s counterclaim and awarded costs of N10 million in favour of Nicon investment and Jimoh Ibrahim who is the 3rd defendant to the counter claimant.

The court also entered judgement in part for Global Fleet because the firm did not prove that First City Monument Bank and Oceanic Bank shares were part of the collateral to secure the loan facility granted by the bank.

The judge subsequently ordered that Messrs FBN Trustees Limited of 10, Keffi Street, Off Awolowo Road, Ikoyi Lagos, Nigeria be appointed as Escrow Agents to: determine the alleged exposure of the firm to Union Bank.

The court held, “For the 3rd defendant to the 1st counterclaim against the defendant: Relief c is dismissed. Relief d is also dismissed as the 3 defendant to the counterclaim has been compensated in costs.”

Abike-Fadipe held that Jimoh Ibrahim was not a necessary party to the suit and was wrongly joined as a party to the suit, as he was an agent of a known principal in this matter.

She held, “There is no competent guarantee before this Honourable Court signed by 3rd defendant to the 1st counterclaim in respect of the alleged loans of the 1st and 2nd defendants to the 1st counterclaim before this Honourable Court.

“The joinder of 3rd Defendant to counter claim in this suit was malicious.

“Union Bank Plc ceases to have power to pursue the alleged indebtedness upon the sale of the said alleged indebtedness to Asset Management Corporation of Nigeria.”

Union Bank expressed dissatisfaction with the judgement of the trial court and indicated it will go on appeal.

Chief Brand and Marketing Officer of Union Bank Plc, Mrs Olufunmilola Aluko, in a statement, disclosed that their lawyers had been directed to immediately appeal the judgement.

Aluko said, “We wish to assure our customers, partners, and the public that Union Bank operates with the highest levels of professionalism, ethical conduct, and legal compliance in all our dealings.

“While we respect the authority of the court, we strongly disagree with the judgement delivered and have instructed our lawyers to file an appeal against it immediately.”

According to her, the court’s findings, including its position on the consolidation of indebtedness, locus standi, and third-party liability, are at variance with established legal principles and the bank’s understanding of the facts.

Aluko expressed confidence in the bank’s legal position, adding that they intend to vigorously pursue all lawful avenues to ensure that justice is served.

He said, “Union Bank had previously transferred the relevant debt obligations to the Asset Management Corporation of Nigeria (AMCON), and we maintain that all actions taken in this regard were in line with applicable laws and banking practice.

“We reiterate our unwavering commitment to acting in good faith, protecting stakeholder interests, and preserving the integrity that has defined our institution for over a century.

“The bank remains resilient and focused on continuing to deliver excellent service and value to its customers.

“We appreciate the continued trust and support of all stakeholders as we navigate this legal process.”