AFEX Vs GTB: The Many Sides of The CBN’s Anchor Borrowers Programme

When Loans Go Bad

The Anchors Borrowers Programme (ABP), a pivotal agricultural intervention spearheaded by the Central Bank of Nigeria (CBN), has encountered numerous hurdles, including weak institutional governance, inadequate risk containment strategies, and a fragile loan recovery framework.

Analysts reckon the program’s intentions had ab initio been wrongly conceived and structured and has been naturally hampered by poor execution, leading to many drawbacks, the latest of which is the recent conflict between AFEX, a pioneer local commodity exchange, and GTCO, Nigeria’s third-largest bank by asset size.

Agricultural lending has always been a tough nut to crack regarding business case and models that often led to loan losses, risks, and farmgate output deficits. Thus, the efforts of AFEX and GTCO to navigate these problems highlight the following questions that now require a meeting of minds to achieve a resolution:

- Appropriate loan pricing to accommodate crop output and sales uncertainty caused by climactic disruptions of social dislocations. Should agricultural loans be given at subsidized interest rates?

- Should crop failure be covered by an agriculture risk protection arrangement? Who should pay the full-face value of the insurance premium? Should the premium be an element of the interest rate charged?

- Should the risk protection service be purely commercial or government-supported?

- Given the challenges with title ownership of farms, how do lending institutions collateralize their agricultural loans?

- Should loan repayment responsibilities remain with farm aggregators or anchors (like AFEX), or should a cooperative cross or co-collateralization approach be adopted?

- Should the asset-centric lending approach replace the output-centric model adopted by the CBN?

The disagreement between GTCO and AFEX over the Anchor Borrowers Programme (ABP) loan repayment is a symptom of weak loan structure and poor governance oversight, ab initio. The programme’s governance architecture did not prepare lenders for shocks to operational cash flows or provide backstop arrangements for output disruption.

A banker familiar with the perils of agricultural lending aptly summarized the situation, ‘On seeing the gaps in Nigeria’s agricultural value chain, you get high on the illusion of farmgate opportunities, but you soon get brought down to earth by the dangers of agricultural losses,’ she noted.

According to the banker who requested anonymity, ‘the anchor borrowers programme was a good idea with an untidy loan resolution framework. It was like a farmer going into virgin land with no soil study, test, or idea of soil composition. Planting seeds in such land is like randomly throwing a stone in a crowded marketplace; anywhere it lands is the presumed target!’

The weak underbelly of the original programme has been exposed by this case and we can now affirm the concerns analyst had raised about such interventions by the Central Bank, urged on by banks like GTCO.

Recall that the ABP was launched to link anchor companies involved in the processing and intermediation of agricultural produce (like AFEX) and smallholder farmers of agricultural commodities. Though the programme recorded initial successes in enhancing agricultural productivity and food security by providing farmers with necessary financial support, the programme has since been plagued by a high default rate, particularly among smallholder farmers, due to poor monitoring and evaluation mechanisms, inadequate extension services, and market instability, which has weakened farmers’ ability to repay the loans.

The rate of the programme defaults has contributed significantly to low agricultural productivity, food insecurity, and disjointed agricultural value chains in the country. Due to farmers diverting the loan or disruptions that weaken the capacity to pay back, loan default has the immediate impact of restricting the capacity to raise new funding and expand operations. As such, productivity is compromised, directly affecting the country’s availability and affordability of food supply. This has also affected operators along the agri-business ecosystem that depends on farm outputs – processors, marketers, and other stakeholders suffer inconsistent supply and increased costs, which has led to business closures and job losses. Consequently, food security is effectively compromised in the country.

AFEX and the Anchor Challenge

Interventions meant to stimulate growth can sometimes turn sour, probably due to the improper implementation process, unstructured plans, and other external factors. A combination of all the above affected CBN’s Anchor Borrowers Fund, introduced under President Buhari in 2015 to boost commodities production. Specifically, the weak incentive repayment structure, supposed diversion of funding to unrelated agriculture, ill-timing of allocation of funds, climatic conditions, and others marred the anchor borrower programme. In numbers, the anchor Borrowers Program has recovered only 52.39% (N503bn) out of N1.08trn disbursed, according to the CBN’s corporate communication department, implying 50% or less is outstanding.

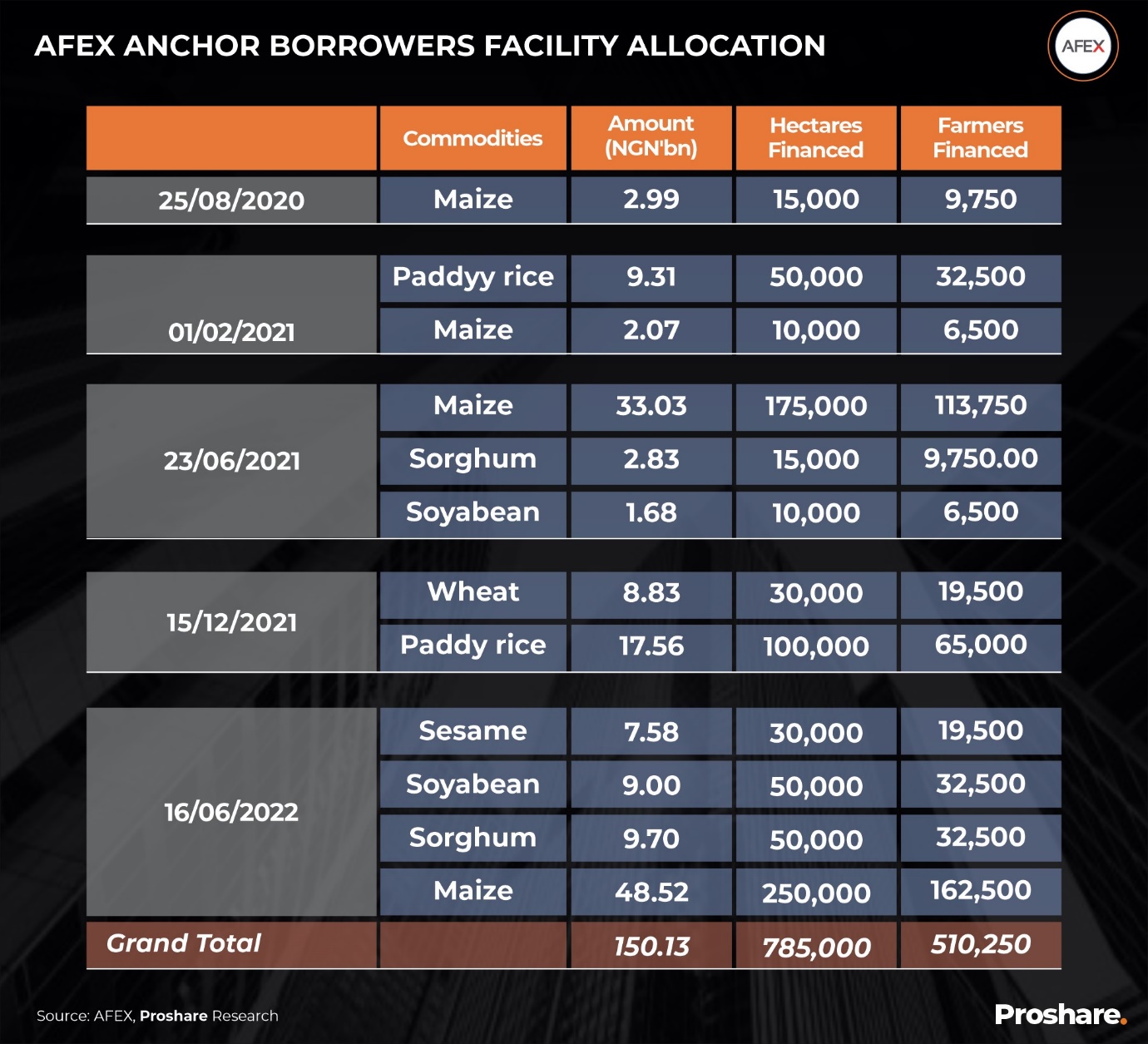

The program was structured through anchors to link to farmers and receive funding from participating institutions. AFEX was an anchor under the private sector-led window, funded by participating financial institutions, including GTBank. Data revealed that AFEX had received N150.13bn under the programme between 2020 and 2022 for farmers of maize, paddy rice, sorghum, soybean, wheat, and sesame. The total number of farmers financed is 510,250, with 785,00 hectares (see table 1 below).

However, AFEX seems to fall under the category of anchors with unpaid loans. GTBank charged the commodity exchange to court over the unpaid N15.77bn outstanding loans, with a maturity date of April 22, 2021, and accrued interest of N2.04bn. The commodity exchange gave slightly different details, claiming it has repaid 100% of the loan values allocated in the 2020/2021 and 2021/2022 seasons, and only 10% is outstanding for the 2022/2023 season.

The delay in payment was linked to macroeconomic and policy headwinds, such as the cash crunch caused by the naira redesign, which affected market participation and sales in the 2022/ 2023 season. The low sales resulted in 40% lower repayment from farmers on input loan bundles from 90% repayment rates in the previous eight years, affecting AFEX’s ability to refund the full value of the loan at the end of Q1 2023 and a 6-month extension period. The Commodity Exchange claimed to have financed a portion of the loan directly from its purse, and the outstanding amounts have been communicated to the CBN.

Based on the eligibility criteria for being an anchor under the programme, the AFEX is responsible for repaying the loans received. Thus, the court charges from GTBANK seem legitimate. The court granted GTBank the liberty to seize AFEX funds and assets, including a directive to all banks in Nigeria to transfer all monies standing in AFEX into the account domiciled with GTBank until AFEX’s entire indebtedness is fully liquidated and directive to policy and civil defence to assist in securing and dealing with the commodities stored in the 16 warehouses across the seven states. The court case was adjourned till June 10, 2024.

Analysts believe that a balanced review of the issue requires further information and clarity on repayment structure, receipts, and documents conveying communication with CBN, but this cannot be provided since the case is still in court. The playout of the unrecovered loan further confirms many analysts’ earlier position that improper repayment structure was a major driver of the failure of the anchor borrower programme.

GTBANK: When Agriculture Turns Ugly

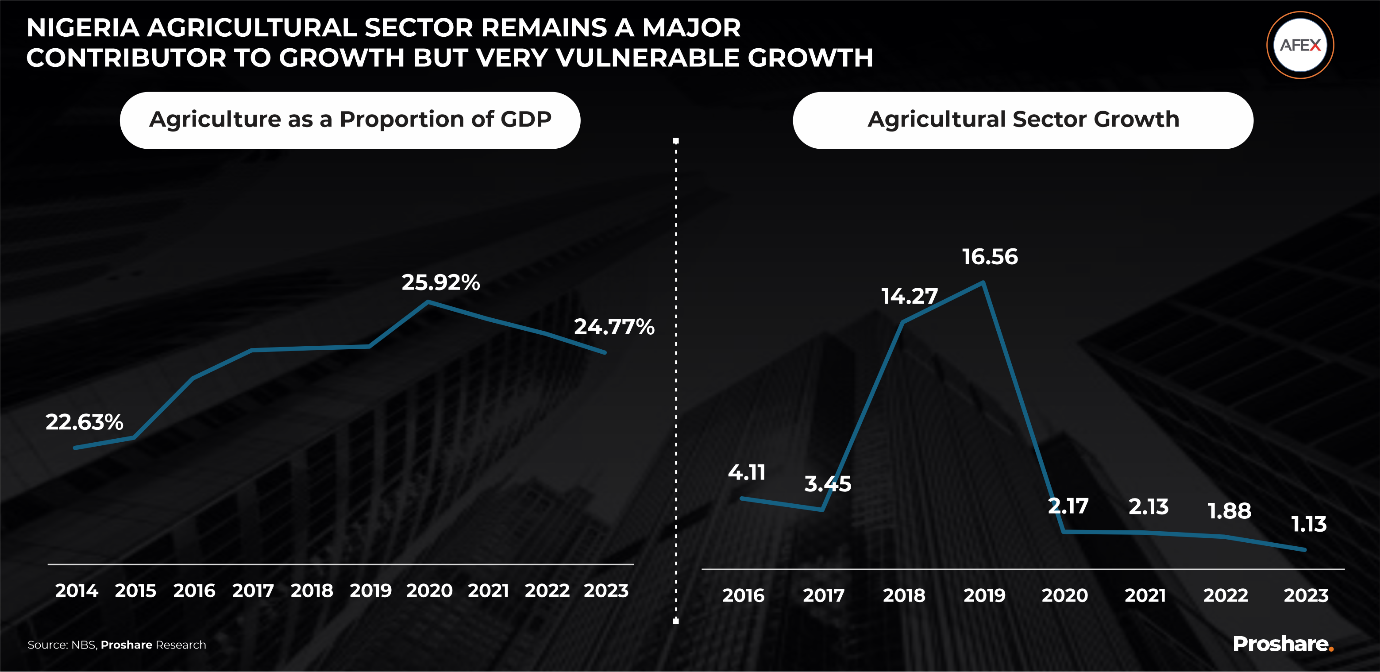

The Nigerian agricultural sector has its array of tales. One tale reveals the sector as a domineering sector in terms of proportion and output contribution to GDP growth in the Nigerian economy. The sector’s dominance goes beyond output to employment provision to millions of farmers directly and indirectly.

The other side of the tale reveals how fragile the sector has become in the last decade, with increasing deterioration of the sector’s growth and productivity. The low growth performance is related to a dynamic array of factors which remain an Agric puzzle while simultaneously making financing decisions a risky venture for many lenders (see chart 1 below):

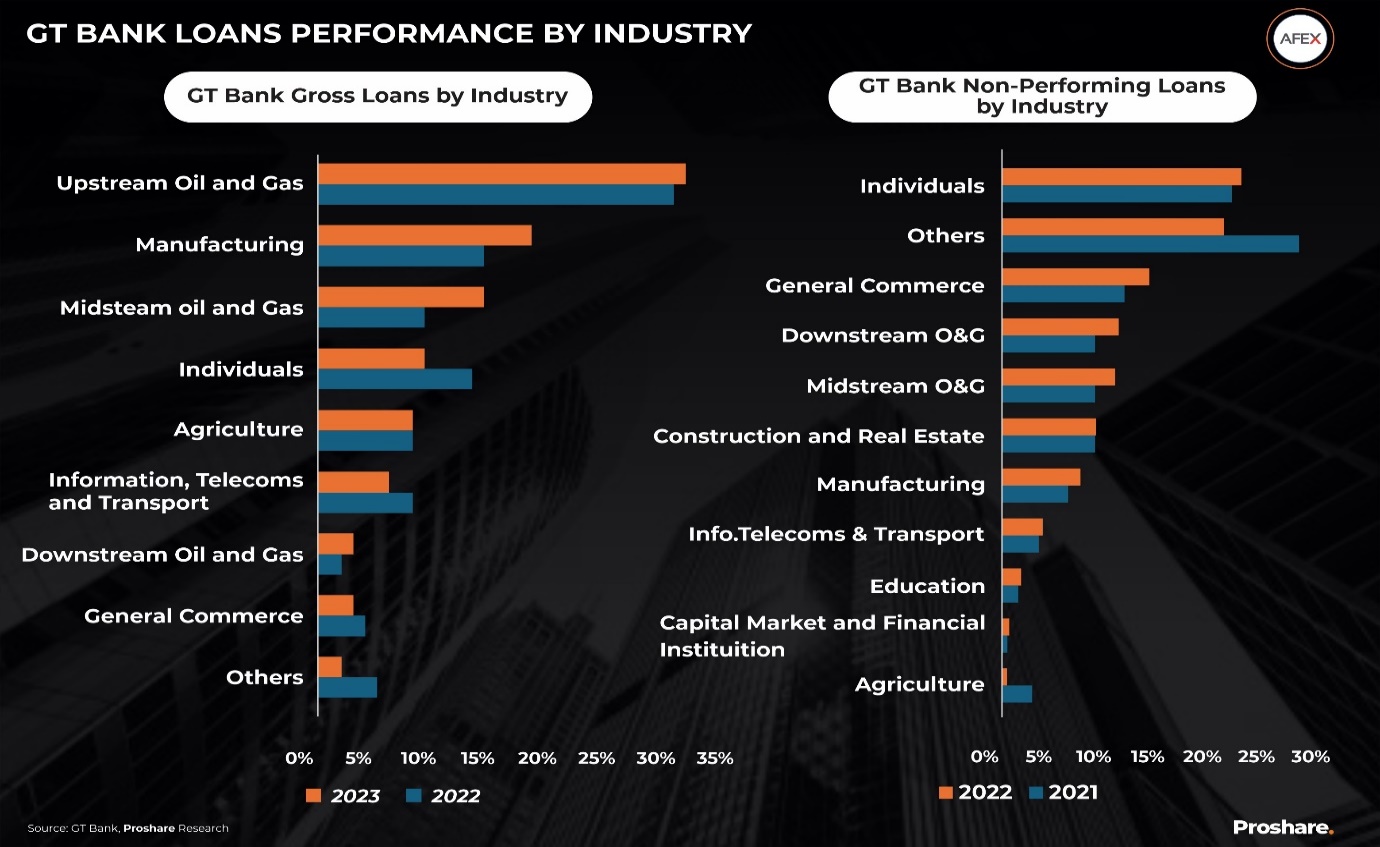

Subsistence farmers largely dominate Nigeria’s agricultural sector. Several programmes and schemes have been rolled out to support the sector’s growth. Lenders like GTBank have agriculture as one of the top sectors and industries they are exposed to (see chart 2 below).

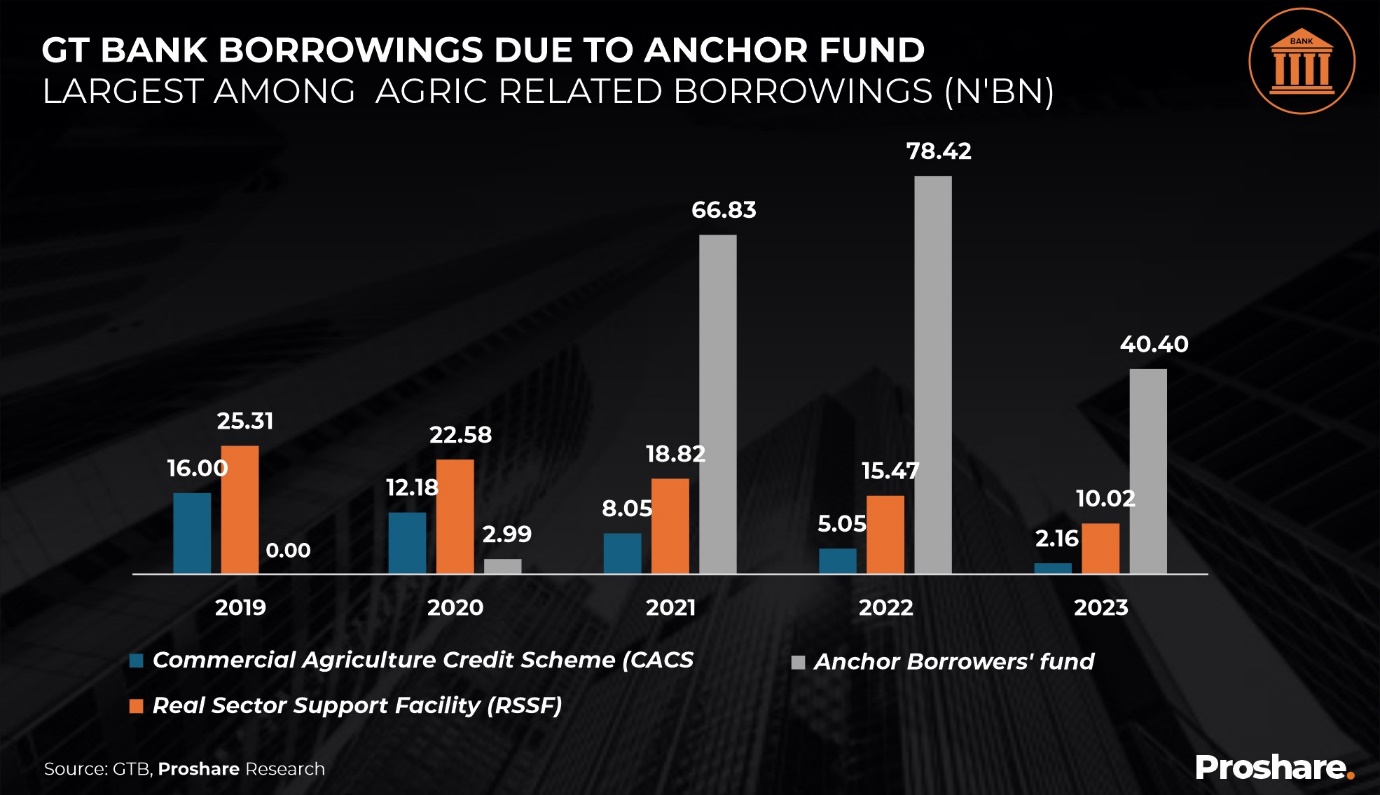

Over the years, GTBank has contributed to financing several agricultural sector development initiatives, such as the anchor borrower’s programme. The anchor borrowers programme (ABP), among other initiatives by the CBN, aimed at enhancing smallholder farmers’ growth from subsistence to commercial production. Borrowings associated with the ABP remain the highest amongst other agricultural intervention programmes in recent times (see chart 3 below):

Anchors such as the AFEX commodity exchange supported more than 500,000 farmers through the ABP, with over N150 billion in financing from GTBank since 2020. The arrangement seemed like a sweet sport for all concerned entities until uncertainties struck in the 2022/2023 season, limiting farmers’ ability to meet their obligations to AFEX and inhibiting AFEX’s ability to settle GTBank fully.

Before the 2022/2023 season, AFEX had met at least 90% of its obligations to GTBank; however, with farmers facing macroeconomic policy shocks such as cash crunch amidst the Naira redesign policy, drop in productive capacity and low harvest, AFEX has disclosed that the situations “resulted in a below 40% repayment from farmers on their input loan bundles down from 90% repayment rates in the previous eight years of providing financing for farmers.”

Unable to recover its funds from AFEX, GTBank turned to the courts while AFEX, on the other hand, called on the CBN to wade in, noting that, AFEX has exposed all limitations “…on the part of the defaulting farmers with suggestions being made to the CBN to activate the risk-sharing structure put in place for the program and release funds accordingly to sustain activities and allow for needed recovery efforts in our agriculture sector.”

Closing Thoughts: From Agriculture to Agribusiness-the New Paradigm

Agriculture and the sector’s funding may require new management, monitoring, and productivity-focused frameworks. The traditional models for agricultural lending may also need rethinking, as agricultural funding programmes require restrategizing. The problem between AFEX and GTCO exposes the risks inherent in agricultural sector lending but also creates the opportunity to review the funding schemes and redesign them to derisk the sector and accommodate the disruptions common to agricultural production.

Using a manufacturing funding model for the agricultural sector lending is convenient but needs to be tweaked for agribusiness. The output uncertainty inherent in agricultural value chains requires a more agile and flexible approach to loan repayments and farmer support. Agricultural output risk protection may need to borrow pages from the playbook of successful agricultural countries like the United States of America (USA), Australia, Canada, Indonesia and China.

Conflict is not confusion or even enmity; AFEX and GTCO can (and perhaps should) find a win-win resolution of the anchor borrowers’ loan problem and document for business future use the learning points that could build a stronger and more resilient agricultural loan programme.

Culled from proshare.co