Agusto & Co Upgrades WEMA Bank’s Rating To Bbb+, Confirms Stable Financial Outlook

Following its strong 2023 financial performance, Wema Bank, Nigeria’s foremost innovative bank and pioneer of Africa’s first fully digital bank, ALAT, has received an upgraded rating from Agusto & Co, validating the Bank as Bbb+ rated with an ESG Score of 2 and confirming a stable outlook for the Bank.

Agusto & Co is a Pan-African credit rating agency and leading provider of industry research and knowledge in Nigeria and Sub-Saharan Africa.

By upgrading Wema Bank’s rating from BBB to BBB+, Agusto has confirmed that Wema Bank is of stable financial standing and more equipped than ever to keep fulfilling its duties as a commercial bank with National authorization.

This development is unsurprising as Wema Bank’s financial strength is reflected in the Bank’s FY 2023 Audited Financial Report.

Among the outstanding results achieved by Wema Bank was a 196% increase in Profit Before Tax (PBT) from N14.75bn to N43.59bn translating to higher pre-tax return on average equity (ROE) and pre-tax return on average assets (ROA) from 21.5% to 43.9% and 1% to 2.1% respectively.

The Bank also recorded a 220.4% increase in Profit After Tax (PAT) from N11.21bn to N33.66bn, 70.63% increase in Gross Earnings from N132.30bn to N225.75, 53.64% increase in Loans disbursed from N521.43bn to N801.10bn, a reduction in cost-to-income ratio (CIR) from 80.1% to 64.4% due to significant earnings growth despite economic fluctuations and 220.53% increase in Earnings per share from N87.2 to N279.5, among other indices.

According to Agusto & Co, “The upgrade of Wema Bank’s rating to Bbb+ is underpinned by improved profitability despite macroeconomic headwinds, lower impaired loan ratio, better deposit mix, strong shareholders’ support as reflected in the successful rights issue exercise and perpetual bond issuance. We have also attached an ESG score of ‘2’, reflecting our view that environmental, social, and governance issues have a minimal impact on Wema Bank’s rating”.

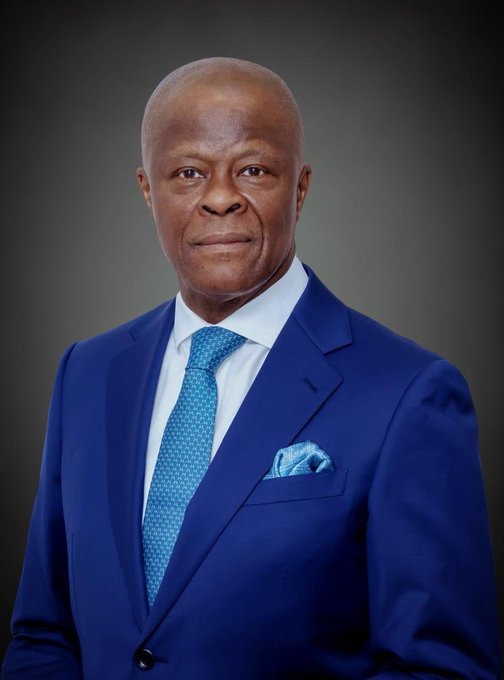

Affirming the Bank’s commitment to providing stakeholders with optimum returns, Moruf Oseni, Wema Bank’s MD/CEO, expressed the Bank’s gratitude to Agusto & Co for acknowledging the strong progress made by the Bank. “Wema Bank is on a journey to the top and we are driven by a commitment to delivering exceptional value, exceeding expectations, and providing optimum returns to every stakeholder—shareholders, customers, employees, and partners alike. It is this commitment that has reflected positively in our numbers and will propel our growth over the next decade”.