Cardoso And CBN Monetary Policies

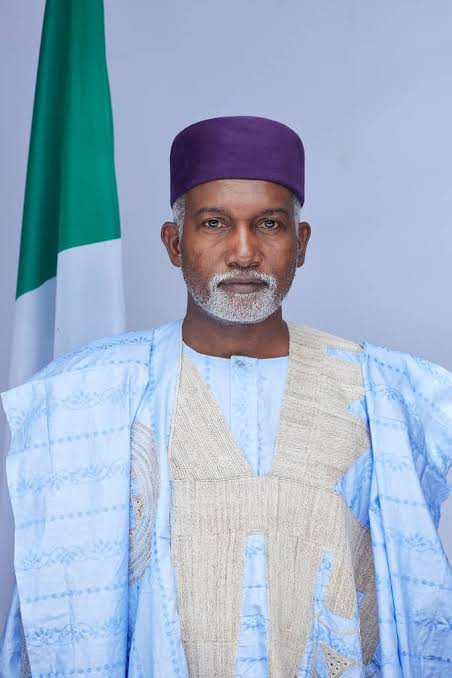

BY BASHIR JALAL

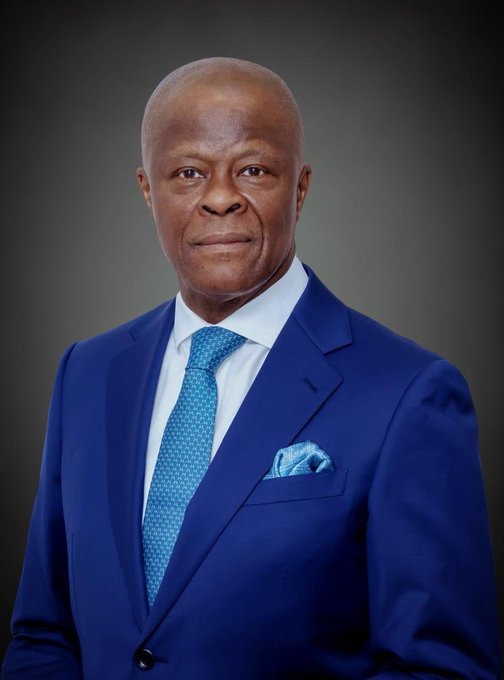

During a recent address at the Harvard Club of Nigeria in Lagos, Olayemi Cardoso, Governor of the Central Bank of Nigeria (CBN), articulated a critical sentiment: “Trust is the currency of central banking.” He emphasised that when public trust in an institution wanes, the effectiveness of its policies is compromised.

“In the face of economic challenges,” Cardoso said, “it is essential to focus on core objectives—restoring the institution’s credibility, building trust in the financial system, and, most importantly, containing inflation. These goals are foundational to any meaningful recovery.”

While Cardoso acknowledged that the CBN has yet to meet its inflation targets, the governor remained optimistic. He pointed to recent data from the National Bureau of Statistics (NBS), which indicated declines in inflation for July and August 2024, as evidence that the central bank is heading in a positive direction.

However, there seems to be a significant knowledge gap among many citizens regarding the differences between fiscal and monetary policies, both of which are vital to a nation’s development as they are used to regulate economic activity and accelerate growth.

Several governments across the world are known to employ two primary tools to manage the economy: fiscal policy and monetary policy. Each plays a crucial role in shaping economic conditions but operates through distinct mechanisms and objectives.

Fiscal policy, managed by government authorities such as the Ministry of Finance, encompasses a variety of strategies involving government spending, taxation, and budget management. Its core goals include stimulating economic growth, reducing poverty and unemployment, and stabilizing prices.

Some examples of fiscal policy in action include substantial infrastructure projects, strategic tax cuts to boost consumer spending, raising taxes to control inflation, and social welfare programs tailored to support vulnerable populations.

Conversely, monetary policy is the purview of central banks like the CBN, focusing on regulating interest rates, managing currency supply, and overseeing credit management. The primary objectives of monetary policy are to ensure financial stability and promote sustainable economic growth.

Central banks utilise various instruments, including interest rates adjustment, quantitative easing implementation, reserve requirements modification, asset purchases, and open market operations, among others, to influence economic conditions.

While fiscal policy exerts a direct impact on economic growth through government expenditures and tax strategies, monetary policy influences the economy by adjusting interest rates and controlling the money supply. This distinction underscores the complementary nature of both policies in effective economic management.

Despite Cardoso’s doggedness and commendable efforts to stabilize inflation, eradicate sharp practices in the foreign exchange market, and regulate the exchange rate, some analysts ignore the complexity of the fiscal landscape of Africa’s biggest nation.

Critics usually point to the weakening of the naira and high inflation rates as indicative of mismanagement without considering the broader fiscal context. Commentators also expect the naira to stabilise at N500 to $1, failing to grasp the multifaceted nature of Nigeria’s economy.

Cardoso has indeed taken a measured approach, particularly in light of the inflationary burdens incurred by previous administrations’ use of “Ways and Means” advances. He has been forthright in not extending similar privileges to the current government until prior obligations are settled.

Moreover, security challenges that plague the North Central and North East regions worsen economic issues. Farmers in these areas find it hard to access their land due to banditry, which has undermined purchasing power, exacerbated poverty, and contributed to Naira’s depreciation.

Attributing Nigeria’s economic struggles solely to Cardoso misses the interconnectedness of monetary and fiscal policies. It is pertinent to mention that financial mismanagement at the state and local government levels are beyond the CBN chief’s purview but gravely impact economic stability.

For instance, the behaviour of some officials fond of speculating on foreign currency markets after the distribution of funds from the Federation Account Allocation Committee (FAAC) inflates the dollar’s value and undermines the naira. Such practices highlight how crucial fiscal decisions can compound monetary issues.

The forces shaping the value of the naira extend beyond Cardoso’s control, encompassing factors like low domestic production exacerbated by insecurity, a high demand for imported goods, dwindling exports, and the substantial costs associated with education abroad and medical tourism.

Ironically, the members of the elite who verbally attack the federal government also contribute to naira’s weakness. In most cases, they prefer foreign products and services, even when local alternatives exist. Furthermore, rising energy prices affect inflationary pressures resulting from fiscal decisions.

As misinformation spreads, it is imperative for advocates of truth to counteract unfounded narratives that unfairly malign the monetary authorities. The CBN has undertaken substantial efforts to stabilize Nigeria’s monetary economy and is shifting focus to other areas that require attention.

Understanding the symbiotic relationship between fiscal and monetary policies is essential in addressing Nigeria’s economic problems. To effectively combat inflation and strengthen the naira, collaboration between fiscal and monetary authorities is of the utmost importance.

From all indications, the Central Bank of Nigeria under Cardoso is aware of its enormous responsibilities and committed to efficient implementation of monetary and exchange rate policy and management. Achieving sustainable solutions requires collective efforts from stakeholders.

–Bashir Jalal writes from Tarauni, Kano