CIFIAN Calls for Policy Coherence on Sugar-Sweetened Beverage Taxation

The Chartered Institute of Financial and Investment Analysts, Nigeria (CIFIAN) has called on the Federal Government to urgently align its sugar-sweetened beverage (SSB) tax policy with broader public health objectives and Nigeria’s industrial development goals.

The Institute warns that steep tax increases, if implemented without a coherent framework, could harm the country’s sugar economy, undermine jobs, and fail to deliver the intended health outcomes.

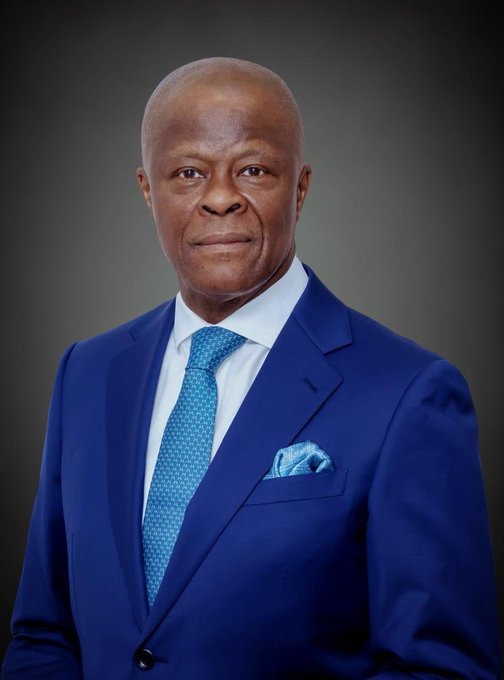

Speaking during a high-level policy workshop themed “Understanding the Impact of SSB Taxation on Nigeria’s Sugar Economy: Supply, Demand, and the Policy Disconnect”, CIFIAN President, Prof. Godfrey Omojefe, said the current ₦10 per litre excise duty on SSBs, introduced in 2022, has already had significant economic consequences.

Citing data from the National Sugar Development Council (NSDC), Prof. Omojefe revealed that national sugar consumption declined by 16 percent in 2023, while domestic sugar production fell by 35 percent — from 46,479 metric tonnes in 2022 to 30,053 metric tonnes in 2023.

He noted that these drops are closely linked to a challenging economic environment and the direct impact of the existing SSB tax on beverage manufacturers, who are among the largest industrial consumers of sugar.

According to him, the SSB tax was introduced with good intentions, but without a holistic policy framework, its impact will remain limited and potentially harmful to local production, investment, and jobs.

The Institute expressed concern over recent proposals by advocacy groups such as the Corporate Accountability and Public Participation Africa (CAPPA), which is calling for a twelve-fold increase in the excise duty from ₦10 per litre to ₦130 per litre.

Such an increase, CIFIAN argued, would likely push retail prices up by between 20 percent and 50 percent, triggering a sharp drop in demand, further reducing aggregate production in the beverage sector, and weakening the Nigerian Sugar Master Plan (NSMP).

The NSMP, a flagship government initiative, aims to achieve self-sufficiency in sugar production, cut dependence on imports, create jobs, and conserve foreign exchange.

However, punitive taxes on sugar’s primary industrial application, SSBs, risk undermining these targets by discouraging investment in sugarcane cultivation, refinery expansion, and backward integration programmes.

CIFIAN also stressed that while sugar and SSB consumption contribute to non-communicable diseases (NCDs) such as diabetes and cardiovascular illnesses, they are not the sole drivers.

Nigeria’s sugar intake remains lower than the World Health Organisation’s (WHO) recommended threshold and is far below that of many African and global peers.

Focusing solely on punitive taxation, without addressing broader lifestyle and dietary factors, will yield limited health gains.

Prof. Omojefe explained that a more effective approach would be to implement a nuanced taxation system that incentivises healthier product reformulation and innovation, while also ensuring fairness across all high-sugar products rather than singling out SSBs.

He further emphasised the importance of offering policy incentives for low-sugar and sugar-free beverage production, especially when using locally sourced ingredients, as this would stimulate agricultural value chains, promote industrial growth, and expand healthier consumer choices.

Equally important, he said, is the transparent utilisation of tax revenue, with clear accountability to show that funds raised are being channelled into healthcare infrastructure, public health campaigns, and preventive health programmes.

Prof. Omojefe added that government should commit to institutionalising regular, independent reviews of the SSB tax every three years, with a mandate to assess both its health and economic impacts. Such data-driven reviews would ensure that policy adjustments are evidence-based rather than politically or emotionally driven.

He also underscored the need for continuous stakeholder engagement between government, health advocates, and industry leaders to find a middle ground that safeguards public health while preserving industrial competitiveness and economic stability.

He concluded by noting that Nigeria’s current approach risks being both economically damaging and insufficient as a public health tool.

A re-engineered, coherent, and evidence-based policy could transform the SSB tax from a blunt fiscal instrument into a catalyst for industrial innovation and improved health outcomes.

“From contradiction to coherence — that is the path Nigeria must take to balance health imperatives with economic sustainability,” Prof. Omojefe said.