FCMB Asset Management’s Private Debt Fund Targets Mid-Sized Businesses

FCMB Asset Management Limited (FCMBAM), acting as Sponsor and Fund Manager, with technical support from TLG Capital Investments Limited (TLG Capital), United Kingdom, recently launched Nigeria’s first Naira-denominated Private Debt Fund, the FCMB-TLG Private Debt Fund (the Fund).

The Fund aims to improve mid-sized companies’ access to suitable capital in Nigeria while offering investors an opportunity to earn a competitive risk-adjusted return on investment.

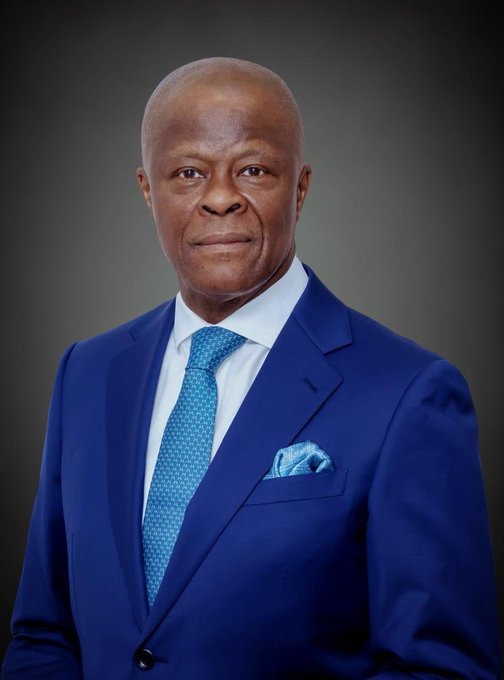

In a recent interview with Bloomberg, James Ilori, the CEO of FCMB Asset Management, shared his vision for the Fund.

He sees the Fund as a catalyst for transforming Nigeria’s financial landscape. Private Debt, also known as Private Credit internationally, has the potential to diversify investment portfolios and drive economic growth and development.

“We found that small companies could borrow from micro-finance institutions and large corporates could get loans from banks, but between them are the mid-sized firms generating roughly Fifteen Billion Naira (N15 billion) to One Trillion Five Hundred Billion Naira (N1.5 trillion) in annual revenue, that struggle to access suitable capital. The FCMB-TLG Private Debt Fund is designed to bridge this financing gap, providing much-needed capital to these vital contributors to Nigeria’s economy,” Ilori said.

The FCMB-TLG Private Debt Fund was approved by the Securities and Exchange Commission (“SEC”) in May 2024 and currently seeks to raise Ten Billion Naira (N10 billion) under Series 1 of its One Hundred Billion Naira (N100 billion) programme (equivalent to about US$ 67 million) from Qualified Institutional Investors (QIIs) such as Pension Fund Administrators (PFAs), Insurance companies, Development Finance Institutions (DFIs), and Family Offices, as well as High Networth Individuals (HNIs). The proceeds of the capital raise will be deployed as corporate debt to companies with commercially viable but impact-oriented activities in sectors of the Nigerian economy aligned with the United Nations (UN) Sustainable Development Goals (SDGs).

The Fund aims to promote economic growth and development in Nigeria by providing suitable capital to support companies in some critical sectors of the economy, such as Agriculture, Healthcare, Education, Clean Energy, IT/Technology, and Transport/Logistics.

The launch of the FCMB-TLG Private Debt Fund represents a significant milestone in Nigeria’s financial landscape as the Fund promises to provide an alternative source of suitable capital for mid-sized companies while creating an opportunity for Qualified Institutional Investors (QIIs) and HNIs to diversify their investment portfolios further as well as earn a competitive risk-adjusted return on investment.

By aligning with the UN SDGs, the Fund further underscores FCMB Asset Management’s commitment to sustainable economic growth and development in Nigeria.