Hotel Brands And Management

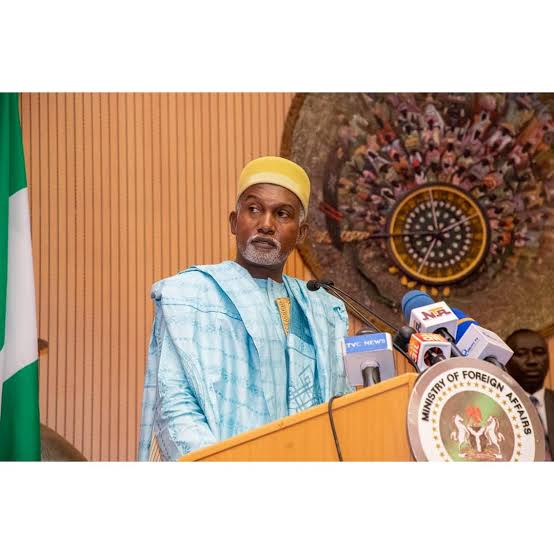

DON EBUBEOGU

I am a frequent traveller, and I like to study the history and management of hotels I visit.

I have always been intrigued by why hotel brands last longer in some countries than in Nigeria and why local hotel chains hardly grow astronomically in Nigeria.

Most of the local hotels do not wake up and die because of low patronage but because of financial mismanagement by the owners.

I used to stay in a particular hotel in Lagos, which has strong occupancy numbers. Guests consistently praised the genuine warmth and dedication of the staff, who were trained by a foreign brand at the hotel’s inception.

But behind the smiles and services from the staff, the hotel’s physical condition was silently deteriorating, slipping further and further from 4-star standards every month. Every visit attracts a negative rating.

Can you guess the reason?

Because each month, the owner withdrew a large sum of their gross revenue—not to reinvest in the property, but to fund unrelated ventures and for “personal flexing”.

What was missing?

CAPEX stands for “Capital Expenditures” and refers to the investments a company or hotel makes to acquire, improve, or maintain assets such as buildings, land, equipment, or furniture.

Under CAPEX is the critical cash reserve for FF&E (Furniture, Fixtures & Equipment), which is an essential financial safeguard to maintain luxury standards and the hotel’s amenities. In many hotels in Nigeria, this fund, which is basically set aside from revenue, is not maintained.

The consequences of mismanaging a hotel include the following:

1. Regular salary payment delays negatively impact staff morale, leading to decreased motivation and potential trained staff turnover.

2. Neglecting tax obligations results in significant penalties that can impose a heavy financial burden on the hotel.

3. Accumulating debt with suppliers can deteriorate partnerships, resulting in unreliable service and diminished quality of goods.

4. Postponing essential renovations indefinitely leads to visible declines in property condition, adversely affecting guest satisfaction and occupancy rates.

The harsh reality? This story isn’t unique. It’s quietly unfolding in hotels nationwide —often hidden behind the curtain.

Short-sighted ownership doesn’t just drain cash flow—it destroys brands.

Responsible hotel ownership must embrace the following:

● Clearly separating CAPEX funding from daily operations (OPEX).

● Fully funding FF&E reserves to protect and enhance the asset’s long-term value.

● Engaging and paying agreed-upon management fees promptly to ensure productive partnerships.

● Making financial decisions to sustain asset quality, not solve unrelated liquidity problems.

Hotels are not ATMs—they’re sophisticated assets requiring disciplined and long-term stewardship.