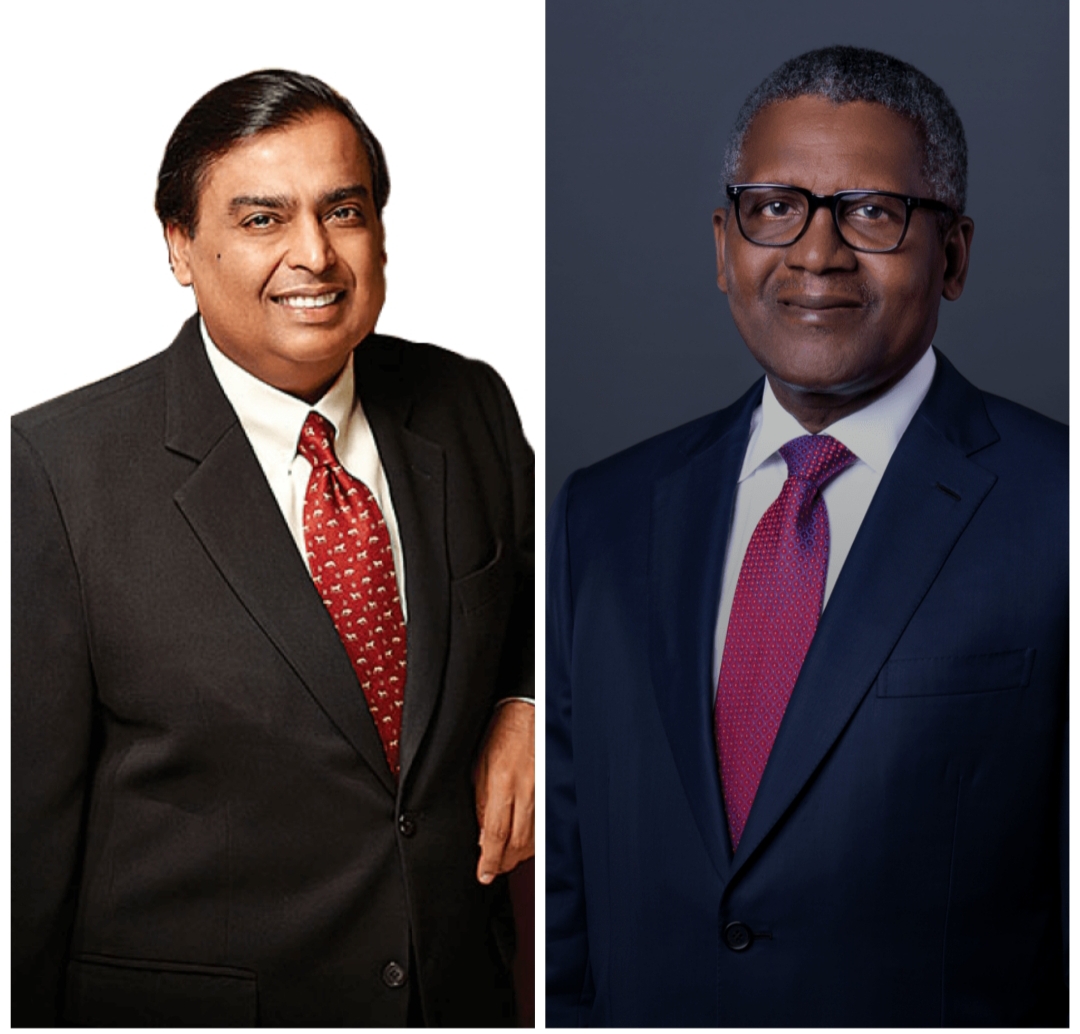

The Tale of Nigeria’s Dangote And India’s Ambani

BY YUSHAU A SHUAIB

The politics of monopoly and oligarchy are familiar phenomena in Nigeria and beyond.

During General Sani Abacha’s military rule in the 1990s, while working at the Federal Ministry of Finance, I witnessed the plight of a retired military officer turned entrepreneur. His product was threatened by a competitor who crashed the price of own goods to make that of the ex-officer uncompetitive. It was suspected that the regime used the competitor to deal with the veteran, who later served in a civilian government.

That experience made me wary of monopolistic tendencies, often leading to concerns about the rise of oligarchies. For instance, Aliko Dangote’s group of companies in Nigeria and Mukesh Ambani’s Reliance Industries in India have dominant influence in their respective countries, raising concerns about the long-term effects of monopolistic tendencies.

In 2005, the administration of President Olusegun Obasanjo endorsed the formation of the Transnational Corporation of Nigeria (TCN), later renamed Transcorp. This conglomerate sought to acquire government-owned assets and venture into various sectors of the economy.

The founding owners were private sector operators and billionaires including Dangote, Femi Otedola, Jim Ovia, Tony Elumelu, Festus Odimegwu, Bernard Longe, Jacobs Moyo Ajekigbe, Funsho Lawal, Tony Ezeanna, Adegboyega Olulade, and the late Waziri Mohammed. The then Director General, Nigerian Stock Exchange (NSE), Ndi Okereke-Onyiuke, was Board of Directors chairman, while a staff member Nicholas Okoye was the technical secretary and business strategy adviser.

In July 2005, President Obasanjo launched Transcorp in the Presidential Villa, Abuja. It was, therefore, not surprising that it benefitted immensely from the government’s privatisation policy, as it raised N16 billion through private placement and acquired significant public assets. These included a 71 per cent stake in NITEL, the Nicon-Noga Hilton Hotel, a 400,000-barrel per-day refinery concession, an oil bloc for upstream oil and gas operations, among others.

While the early promoters of the mega-firm later became prominent advocates for Obasanjo’s alleged third-term agenda, there was a controversy surrounding the ex-President acquisition of millions of shares through a blind trust fund financed by a popular bank. For whatever reasons, some years after the acquisition, a number of the company founders appeared to have parted ways.

In an article in June 2005 titled “President Dangote of Nigeria”, I cautioned business moguls about the dangers of retrogressive monopoly, which weakens government regulations and kills healthy competition. Instead, I suggested that private sector players deploy infrastructural facilities and equipment to gain fair market share rather than acquiring public institutions at giveaway prices.

Dangote expanded his businesses into manufacturing like Mukesh Ambani, the wealthiest man in India, who is reputed to have lavished over $800 million on the wedding of his son, Anant Ambani, to Radhika Merchant, the daughter of Indian pharma tycoons, Viren and Shaila Merchant. While Dangote has a flour milling company that produces wheat flour, pasta, noodles, etc, Ambani’s investments include retail outlets that operate supermarkets and online trading platforms.

Similarly, besides his telecommunications company offering 4G and 5G services, comprising data and other digital products, Ambani also produces films, television shows, and digital content through his media and entertainment company. He equally operates large power generation plants and distribution companies.

Dangote additionally operates fertilizer and cement corporations in Nigeria and other African countries. He has also heavily invested in agriculture, focusing on producing rice, sugarcane, and tomato paste. In addition, Dangote refines salt and sugar for domestic consumption and export.

As nonpartisan and detribalised businesspeople, both Dangote and Ambani are generous to different political parties, religious groups, and cultural institutions. They also employ elite graduates from various ethnic backgrounds and engage youths in multiple roles in their enterprises.

The giant cash cow of Ambani is his Reliance Industry’s Jamnagar oil refinery, commissioned in 1999, with the capacity to produce 668,000 barrels of crude daily, which has since been upgraded to 1,240,000 barrels per day. The refinery has enhanced India’s energy security by providing a reliable source of petroleum products, contributing to the country’s GDP growth, and becoming a key player in India’s energy sector.

When Dangote mooted the idea of building an oil refinery, as the Nigerian government failed to revive the existing ones or create new ones, many believed he was on the trajectory of receiving the usual incentives he gets from the government as one of Nigeria’s most prominent private sector players.

The success story of Ambani’s refinery is attributed to the active support of the Indian government in encouraging investments in the energy sector through support that includes tax incentives, subsidies for importing crude oil, enabling the exportation of refined products, and relaxation of regulations to allow efficient operations. The government’s monetary policies enabled banks and financial institutions to provide loans and credit facilities for indigenous projects.

With the government’s magnanimity to the industry, India’s economy benefits from Ambani’s refinery, with thousands of jobs created, infrastructure development in the host communities, and foreign exchange earnings from exporting refined products. The company’s operation also reduces dependence on imported refined products while generating significant revenue for the government through taxes, duties, and royalties.

Meanwhile, within just a few months of its operation this year, the multibillion-dollar Dangote refinery has created thousands of jobs, directly and indirectly, while stimulating economic growth. Whilst there was excitement that the refinery would increase the domestic refining capacity and reduce reliance on fuel importation, thus decreasing inflationary pressures, the regulator recently publicly demarketed the company’s petroleum products.

Speaking on behalf of the government, Managing Director of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Engineer Farouk Ahmed claimed that the quality of products from the Dangote Refinery was inferior, citing a purported higher sulphur content of the diesel produced.

Claiming that the refinery had not yet been issued an operational license, and concern over monopoly and energy security, the NMDPRA pushed an argument for the continued importation of petroleum products from outside the country. The management of the refinery has denied the allegations of either producing high sulphur content diesel and an attempt at becoming a monopoly.

The painful irony is the seeming demarketing of the Dangote brand by his brethren from the North, after Southerners had provided him with an enabling environment for the business that would generate foreign exchange earnings, contribute to Nigeria’s economic diversification, and ultimately stabilise the naira. The Northerners need rethinking.

Examples abound of how great nations implement policies to support indigenous industries through protectionist measures that give them a competitive edge in relation to foreign businesses. This is done through legitimate preferential concessions, financial incentives, creation of pathways for market access, regulatory backing, and offers of equity participation.

If the Nigerian system cannot support indigenous enterprises, it shouldn’t be seen as demarketing them.

Shuaib is Editor-in-Chief at PRNigeria, and Economic Confidential. He can be reached via

yashuaib@yashuaib.com