We’ve 37 Interventions To Boost Economy –CBN

The Central Bank of Nigera says it has 37 interventions in various sectors to boost the nation’s economy.

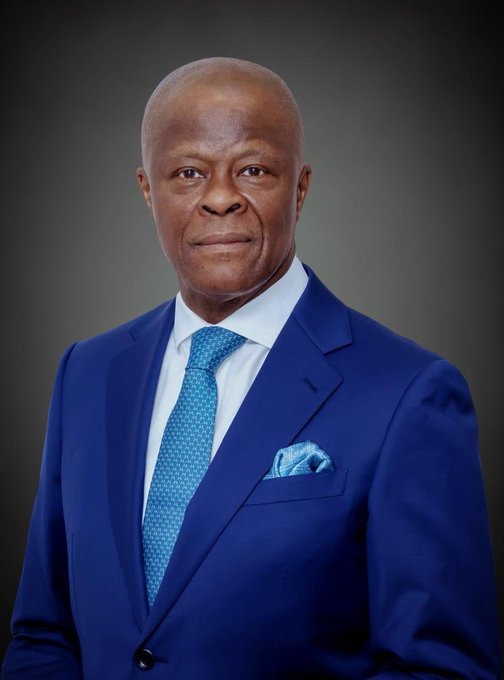

This was disclosed Thursday by the Governor of Central Bank, Godwin Emefiele represented by the Acting Director, Corporate Communications, Mr Osita Nwanisobi.

Speaking at the two-day CBN Fair in Calabar with the theme: Promoting Financial Stability and Economic Development, he said, “We have 37 interventions in CBN.These interventions are targeted, like the targeted credit facility, health sector intervention, commercial agric credit scheme, real sector support facility, electricity market stabilisation fund, etc. The issue is about the functionality and why the intervention comes to be.

“During the heat of the COVID-19 pandemic last year, we realised that the global economy was shut down, families and businesses were affected. The first thing the CBN did was to roll out some interventions to mitigate the impact of COVID-19 on livelihood and businesses. That was how the targeted credit facility came on board.

“It was basically a health crisis and we needed to up our game in terms of health infrastructures. Interventions, as I earlier said, are targeted based on identified gaps to help rejig the economy.”

He also spoke on why CBN is investing so much in agriculture.

“Unless we go back to agriculture, we will be struggling. Our mono economy is the reason why we are where we are today. Agriculture will get our country running. Unless we do this, we won’t make much progress,” he said.

Nwanisobi further stated that Central Bank of has helped to the recover N89.2b for 23,526 commercial bank customers as of June 2021.

“The money was based on the complaints individuals raised. Often times, there have been issues and issues on charges. What we do is that when we get these complaints, we investigate and if the issues are found to be true, the banks make refund, “he said.

“The CBN Fair is to create awareness on our policy and interventions, programmes. We also use this opportunity to build confidence in our financial system and to disabuse the minds of our people against the rumours of distress in the system. There is no distress at all. Our financial system is sound, is resilient. It is safe and it is stable.

“We also seek to get feedback from them on how the policies are impacting on their lives and businesses.”