2022 Budget: N10.13trn Revenue Forecast, Budget Parameters Unrealistic, Overtly Ambitious – Dr Uba

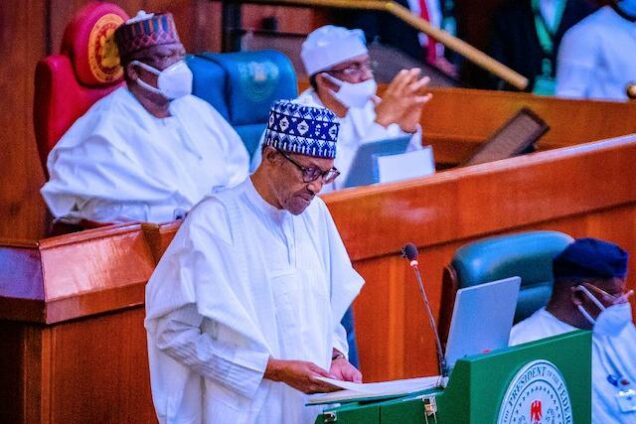

A development economist, Dr. Chiwuike Uba, has said that the 2022 budget proposal presented to the joint session of the National Assembly by President Muhammadu Buhari on Thursday, as presently constituted, may be difficult to be implemented by the government.

In a statement made available to the media in Enugu on Friday, Uba, who is also the Board Chairman of Amaka Chiwuike-Uba Foundation (ACUF), said that the revenue forecasts and some other budget parameters may be unrealistic, adding that the usual credibility problems of previous budgets are likely to shadow the 2022 budget

He said: “The presentation of the 2022 budget proposal to the National Assembly by the President more than two months prior to the start of the next fiscal year is laudable. This would give the National Assembly sufficient time to conduct the required legislative review of the budget. Most importantly, it will also allow for public consultation and citizen input into the budget prior to its passage into the appropriation act. Nevertheless, a cursory review of the proposed fiscal parameters shows that the budget proposal reflects the future of past years budgets. Yes, the budget is replete with some of the mistakes of the past budgets.

“The parameters of the 2022 budget proposal mirror the budget of recent years, both in terms of structure and character. The revenue forecasts and some other budget parameters appear very unrealistic, so the usual credibility problems of previous budgets are likely to shadow the 2022 budget. Clearly, as a nation, we are doing little or nothing to cut our clothes in accordance with the materials available. It is clear that we still have an incremental fiscal structure, regardless of the state of the economy. Consumption mentality is based on borrowing, with little or no real sustainable strategy to break out of the fiscal abyss and the debt trap. We must reflect and discuss whether we should grow and strengthen the economy. The 2022 budget proposal in its current form may not achieve the budget’s objectives.

“The 2021 Budget, which was called the budget of stabilization and economic growth, has so far been unable to meet up to 30 per cent of the government’s fiscal policy objectives. At least, according to the government’s half-year report, the economy is yet to witness the desired growth outside the GDP growth statistics. The 2021 budget has so far delivered mixed results. There are some commendable positive results, as well as negative results. There is a considerable improvement in the non-oil revenue. Nonetheless, the nation’s economic growth and stabilisation seem very weak, with an attendant depletion of accrued savings (external reserves) and other State resources. Unlike the 2020 half-year, when the government made a transfer of USD$ 250 million to the Nigerian Sovereign Wealth Investment Authority, NSWIA has received no transfer in 2021.

“External reserves decreased by 10.6 percent, from US$36.48 billion in December 2020 to US$32.99 billion in June 2021. The trade deficit also increased sharply, reaching around US$4.23 billion. Import growth remains very high relative to our export growth rate. Relative to 2020, Nigeria’s trade deficit in the first half of 2021 rose by N3.56tn and stood at N5.81tn in June 2021. With an import growth rate of 60.67% in the first half of 2021, Nigeria’s export growth rate of 26.18% had little or no impact to stabilize or grow the economy.

“In the first half of 2021, the federal government accumulated an additional public debt of around N4.9trn (foreign debt – N897bilion, domestic debt- N1.61trn). Additionally, N2.4trn loan was received from the CBN via Ways and Means Advance. It is important to note that the value of the Ways and Means provided to the federal government by the CBN violates applicable laws. External debt increased by 8.5%, from N10.95trn in December 2020 to N11.85trn in June 2021.

“In the same vein, domestic debt increased by 10%, from N16.02trn in December 2020 to N17.63trn in June 2021. Previous administrations continued to accumulate public debts after the cancellation of the nation’s debt during the President Obasanjo administration. Since 2015, the public debt of the federal government has experienced an annual increase, rising from less than N10trn in June 2015 to N29.48 trillion in June 2021. Unfortunately, the federal and state governments seem to be obsessed with the debt-to-GDP ratio, regardless of the debt-to-income ratio. It’s untenable and unacceptable for the country to continue on the borrowing frenzy just to finance consumption. Current debt is used mainly for debt servicing and recurrent expenditure rather than capital projects.

“According to the half-year budget implementation report, as of June 2021, only 27% (N1.34trn) of the money from the total public debt of N4.9trn was released to fund capital expenditures (including additional capital expenditures). This implies that all the revenue of the government and about 73% of the accumulated public debt in the first half of 2021 was used for debt servicing and also to fund recurrent expenditures. The usual expectations are to fund capital projects, especially projects with the ability to repay costs and stimulate economic growth. The future of generations to come is gradually mortgaged, without any demonstrable sustainable commitment to policy to stabilize and grow the economy.

“The inherent low capacity of the MDAs to use the funds released to implement capital projects is more worrisome. According to the half-year budget implementation report issued by the Budget Office of the Federation, the federal government has released on average, 30% of the annual capital appropriations to the MDAs. Nevertheless, only 46% of the funds released have been utilized by the MDAs. Total cash released and utilised by water resources is 20% and 22% respectively. For education, the release is 22%, and utilisation is 11%) and health (release 28%, utilisation 23%).

“The records for capital release and utilisation by other MDAs show that Ministry of Works and Housing release is 27%, utilisation 61%; Transport (release 25%, utilisation 57%); and Agriculture (release 68%, utilisation 46%). Aviation has a release of 24%, and utilisation of 4%; Science and Technology (release 35%, utilisation 6%), Niger Delta (release 24%, utilisation 48%), FCTA (release 24%, utilisation 0%). Finally, Defence has a release of 45%, and utilisation of 93%; ONSA (release 30%, utilisation 95%), Interior (release 16%, utilisation 36%), Trade and Investment (release 29%, utilisation 93%), Power (release 33%, utilisation 82%) and average release and utilisation by all other MDAs is 29% and 55% respectively.”

He added: “The N10.13tn’s forecasted revenue in 2022 appears to be unrealistic. This finding is based on the analysis of the 2021 half-year results and the revenue parameters for the 2022 revenue budget. First, as of June 2021, actual revenues for the federal government were N2.3tr, 43% less than budgetary revenues for the first half of 2021. Neither does it look that the second half of 2021 is a promising one.

“There are also some unbudgeted deductions from oil revenues in the first six months of 2021. For instance, N506.58 billion was deducted for Base JV Cash Call+EF+MCA+RA. N38.98 billion was also deducted as DPR 4% Cost of Collection (Royalty, Concessional, Gas Flared & Miscellaneous). Finally, another unbudgeted amount of N3.9 billion was deducted for the FIRS 4% Cost of Collection on Gas Income Tax.

“Since 2015, the federal government’s actual revenues have remained below the revenue budgets. In 2015, the actual revenue was N3.24tn, N3.86tn in 2019, and N3.42tn in 2020. This is less than a 20 per cent increase in 2019 over 2015 and a 12.9 per cent decrease in 2020 over 2019.

“Many of the 2022 budget parameters appear to either unrealistic or overtly too ambitious. Without any doubt, the budgeted oil price benchmark is in order and could be realized. However, raising the daily oil production budget to 1.88 million barrels per day is overly ambitious and unrealistic. The average daily oil production for the first half of 2021 is 1.61 million. Consequently, it is virtually almost impossible for the federal government to reach 1.88 million in production in light of the increasing insecurity in Nigeria, among other issues.

“In addition, despite governments efforts to tackle insecurity, it does appear that such efforts are not properly targeted to address growing insecurity. This claim can be traced to new agitations by separatist groups, banditry, kidnapping for ransom and farmer-herder crisis among others. More so, the average percent of budget release to agencies responsible for security in Nigeria is relatively poor. According to the half-year budget implementation report, the federal government has yet to transfer approximately N16.61 billion into the Police Trust Fund. The amount is supposed to be the trust fund share of the VAT collected during the half-year.

“The target inflation rate of 13% and GDP growth rate of 4.2% are fairly realistic. That is, if and only if national productivity increases and food inflation decreases. On the other hand, the rate of inflation could reach 15% by the end of 2022 if the pump price of fuel and the price of electricity are raised and if insecurity is not dealt with adequately. Nonetheless, achieving the projected GDP growth of 4.2% would not necessarily lead to economic development or growth, except that there is job creation. What Nigeria needs today is inclusive growth and not the usual bubble growth, as evidenced by GDP growth in the past years.

“The N410.15/$1 exchange rate and projected budget deficits appear to be relatively unrealistic based on available data and trends. First, in June 2021, Nigeria is operating three exchange rate markets – the official market, the import and export window market and the parallel market (BDC), with different rates. It would be difficult for the exchange rate to stabilize or converge without the factories, farms and other job-creation companies prospering. Most importantly, no real investor would invest in an economy with volatile and multiple exchange rate regimes. The CBN is currently working so hard to achieve a stable exchange rate, but we may have to float the exchange rate and allow forces of the market to determine the real exchange rate. Why are NNPC, FIRS, and some large conglomerates and multinationals not operating in the import and export window? In fact, pegging the exchange rate at N410.15/$1 makes room for the black market and round-tripping.”

Continuing, he said: “The N3.6 Trn’s 2022 budget for debt service is extremely unrealistic. In the first half of 2021, the total debt service is already N2.02trn, which is more than 21 per cent higher than the budgeted debt service of N1.662trn for the same period. This means that the total debt service payment in 2021 may be in the vicinity of N4.3trn. This projection is based primarily on the six-month report and the galloping growth rate of the public debt. Nigeria is accumulating more and more debt in 2021 and plans to finance the 2022 fiscal deficit with additional loans. Furthermore, the 2022 budget deficit of N6.5trn may likely increase by the end of 2022. This in turn, would impact on the additional debt requirement to fund the budget. Taking these assumptions into account, N5.0trn would provide a more realistic debt service budget in 2022.

“It is not practicable to diversify the economy without making available the funds required for the development. The cost of governance has remained on an upward trend every year since 1999. The capital budget accounts for only 33 percent of the proposed 2022 budget. Over 50% of the N3.31trn increase in the 2022 budget proposal over the 2021 budget is earmarked for debt servicing and recurrent expenditures. As shown by the previous year’s actual capital expenditures, the performance of the capital budget is typically less than 50% and most projects are rushed through late in the fiscal year. This creates integrity issues, as an adequate cost-benefit analysis that ensures value for money is seldom strictly observed in awarding such hasty contracts.

“Achieving the 2022 budget targets of economic growth and consolidation requires real investment in key infrastructure, health, education and other key economic and social sectors. Infrastructure funding through Public-Private Partnership (PPP) mechanism, as well as CBN funding for targeted sectors, needs to be deepened. Nigeria needs to replicate large businesses such as Dangote across the country. Seventy-two large and strong corporations in each state are better than the millions of enterprises financed by the CBN with no real and measurable impact on the economy. Economic growth and consolidation are beyond good speeches, it demands bold decisions.

“Why do we have many government agencies responsible for midwiving capital projects and development, without the corresponding results? Do we really need to continue funding agencies such as the Bank of Industry, Development Bank of Nigeria, Bank of Agriculture, Infrastructure Concession Regulatory Commission (ICRC), and other related government agencies when such agencies appear not to be fulfilling their mandates? Redesigning our development strategy is important.

“In his speech on the 2022 budget proposal, the President made reference to a national development plan. For any development plan to succeed, adequate public consultation aimed to gather public feedback is important. The citizens need to own the process and the output/document for it to be sustainable. Therefore, the national development plan process requires public input and feedback. Having made the above analysis, I will be able to make a more informed analysis and contribution to the proposed 2022 budget when the full budget proposal is released to the public. Nigeria is bound to do better. God is with us!”