Payslice Hits $1m Transactions, Plans Expansion

Posted on February 1, 2023

Technology solution company, Payslice has disclosed that it grossed over $1m in transactions in the provision of cash flow for employers and employees last year.

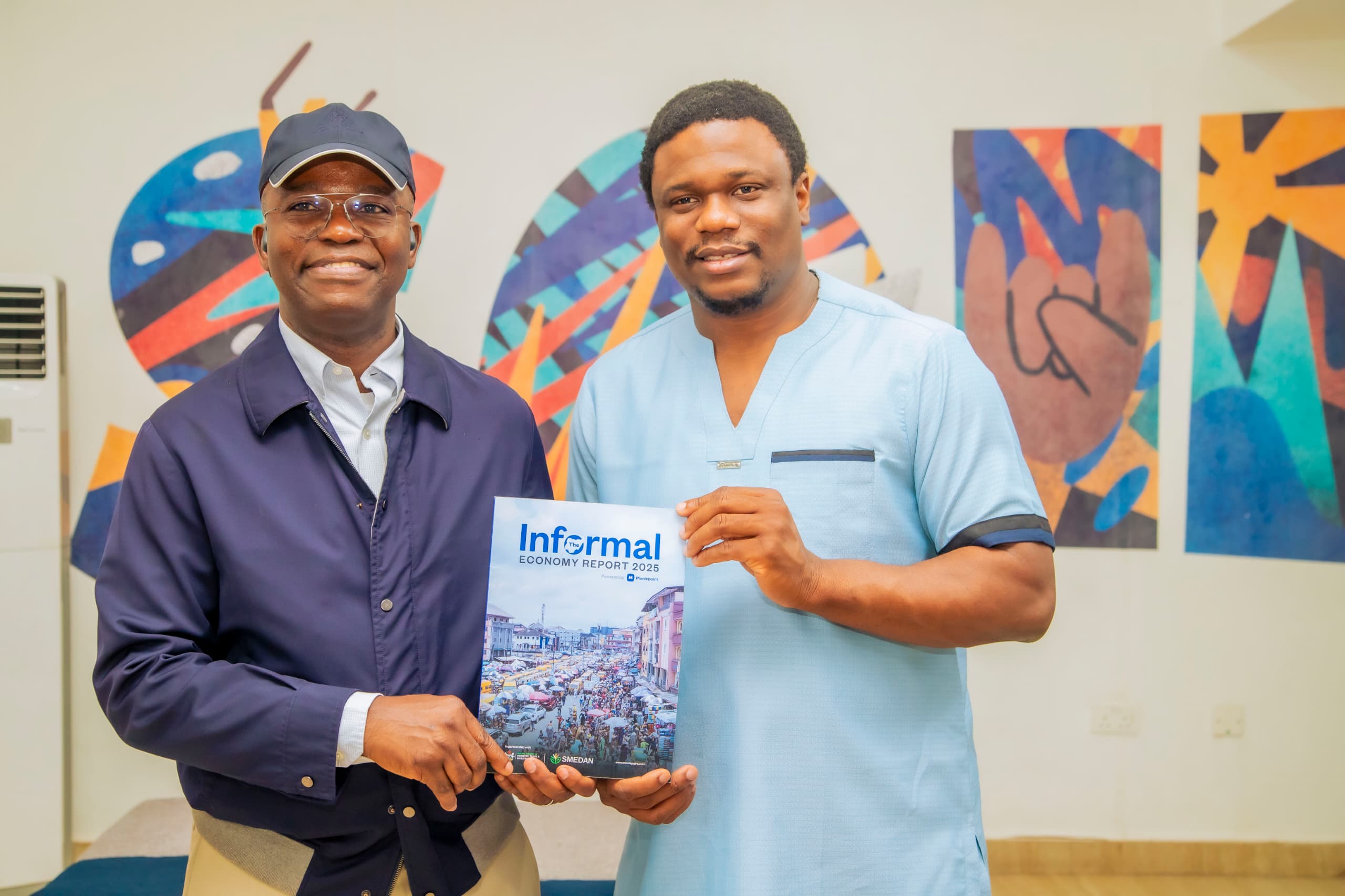

Co-founder Kelechi Oleka disclosed this in Lagos at the weekend during the company’s formal launch.

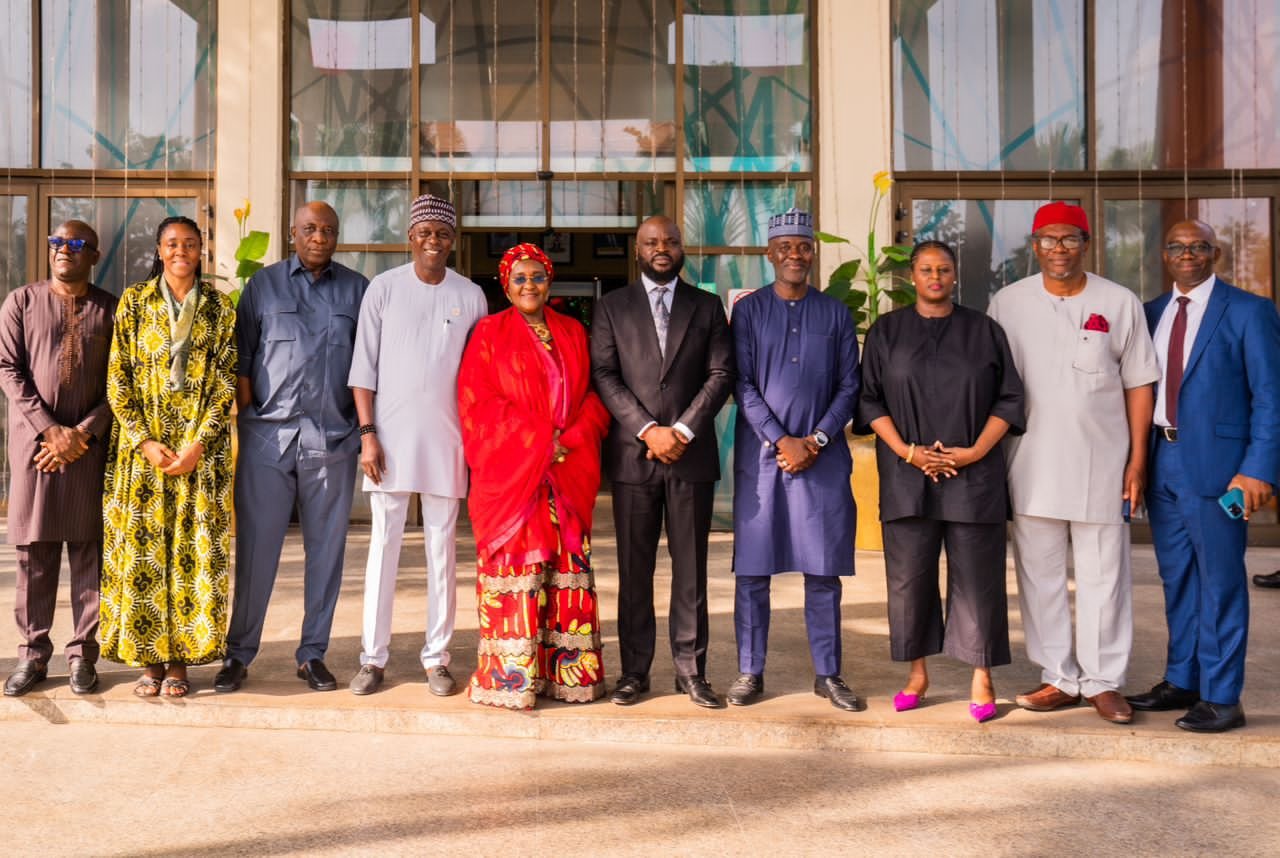

Present at the event were Payslice’s Co-founder and Chief Technology Officer, CTO, Joseph Agboro, Chief Operations Officer, COO, Bolaji Odunaiya, Investor, Samuel Ajiboyede, representatives of major clients of the platform, and their employees.

Speaking at the event, Oleka stated that within a 12-month operation circle, Payslice provided Payroll financing to employers to boast cash flow while also giving their employees access to their earned pay before the end of the month. “Payslice did over $ 1 million in banking transactions last year and we are proud of that especially because we are relatively new and better than other platforms offering similar service,” Oleka said during his presentation.

He explained that Payslice is not a loan service provider but a solution designed to take care of the immediate cash needs of employers and employees before their next payment circle.

Speaking on the motivation behind Payslice, Oleka said: “One of the things we realized during the Covid-19 era was that a lot of loan sharks were out there embarrassing people for taking little loans.

“We found that what was missing was the need for small funds by people to take care of their immediate needs before their salaries or paychecks come in. We are glad that the advent of Payslice has effectively sent loan sharks out of business.”

On Payslice’s plans for the coming years, Oleka said: “We have started a conversation with top companies and multinationals in the country and many of them have come on board. Our focus is on frontline workers, like Uber, doctors, nurses, security outfits drivers, cleaners, site workers, etc who need cash flow on a day-to-day basis.

“We currently have an insurance system so all the transactions on the platform are secured. Both employers and employees are assured that their funds are safe. We are already working on implementing USSD on the platform for more transaction gateway options.

“The last year has been good and we are looking at getting more clients to enroll in the system. We estimate that in the next three years, we would have reached 1 million employees onboard with each employee having access to their earned salary twice before the end of the month.”

Categorised as : Banking | Finance, ICT

No Comments »

Related posts