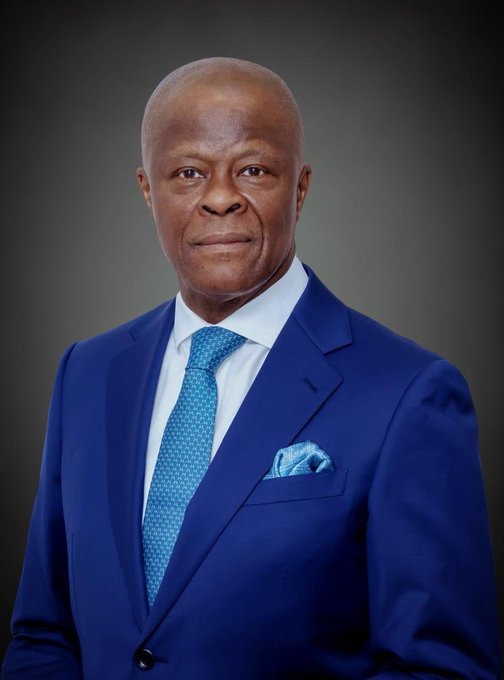

Dr Umar A. Oseni Appointed Into CBN’s Financial Regulation Advisory Council

In a significant move, the Central Bank of Nigeria (CBN) has appointed Dr. Umar A. Oseni, the esteemed Mufti of Auchi Sacred Kingdom in Edo State, as a distinguished member of the Financial Regulation Advisory Council of Experts. This appointment underscores the CBN’s strategic emphasis on strengthening its regulatory framework, particularly in the domain of Islamic finance.

Dr. Oseni brings a wealth of experience to his new role, having previously served as the Chief Executive Officer of the International Islamic Liquidity Management Corporation (IILM), headquartered in Kuala Lumpur. His leadership at IILM showcased exceptional strategic acumen in navigating the complexities of global finance. Dr. Oseni’s international recognition is further evidenced by his tenure as Executive Director (Legal and Compliance) and Acting CEO at IILM.

Moreover, Dr. Oseni’s membership in the Governance and Ethics Board of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) highlights his influential presence within the Islamic finance community.

In academia, Dr. Oseni has made significant contributions as an Associate Professor of Law and Regulation of Islamic Finance at the International Islamic University Malaysia (IIUM). His expertise is further augmented by a visiting fellowship at the Islamic Legal Studies Program of Harvard Law School, Harvard University, and certifications as a Harvard-certified negotiator and dispute resolution expert.

With a prolific publication record spanning Islamic finance law, arbitration, and dispute resolution, Dr. Oseni is widely regarded as a leading authority in his field. His forthcoming book, “Islamic Contract Law,” commissioned by the Oxford University Press, adds to his scholarly contributions.

Dr. Oseni’s appointment to the Financial Regulation Advisory Council of Experts signifies the pivotal role he will play in shaping policies and regulations governing non-interest financial institutions in Nigeria. It underscores the CBN’s commitment to fostering a resilient and inclusive financial sector, aligned with global best practices, and attuned to the evolving needs of Nigeria’s economy.

Categorised as : Banking | Finance, News

No Comments »

Related posts