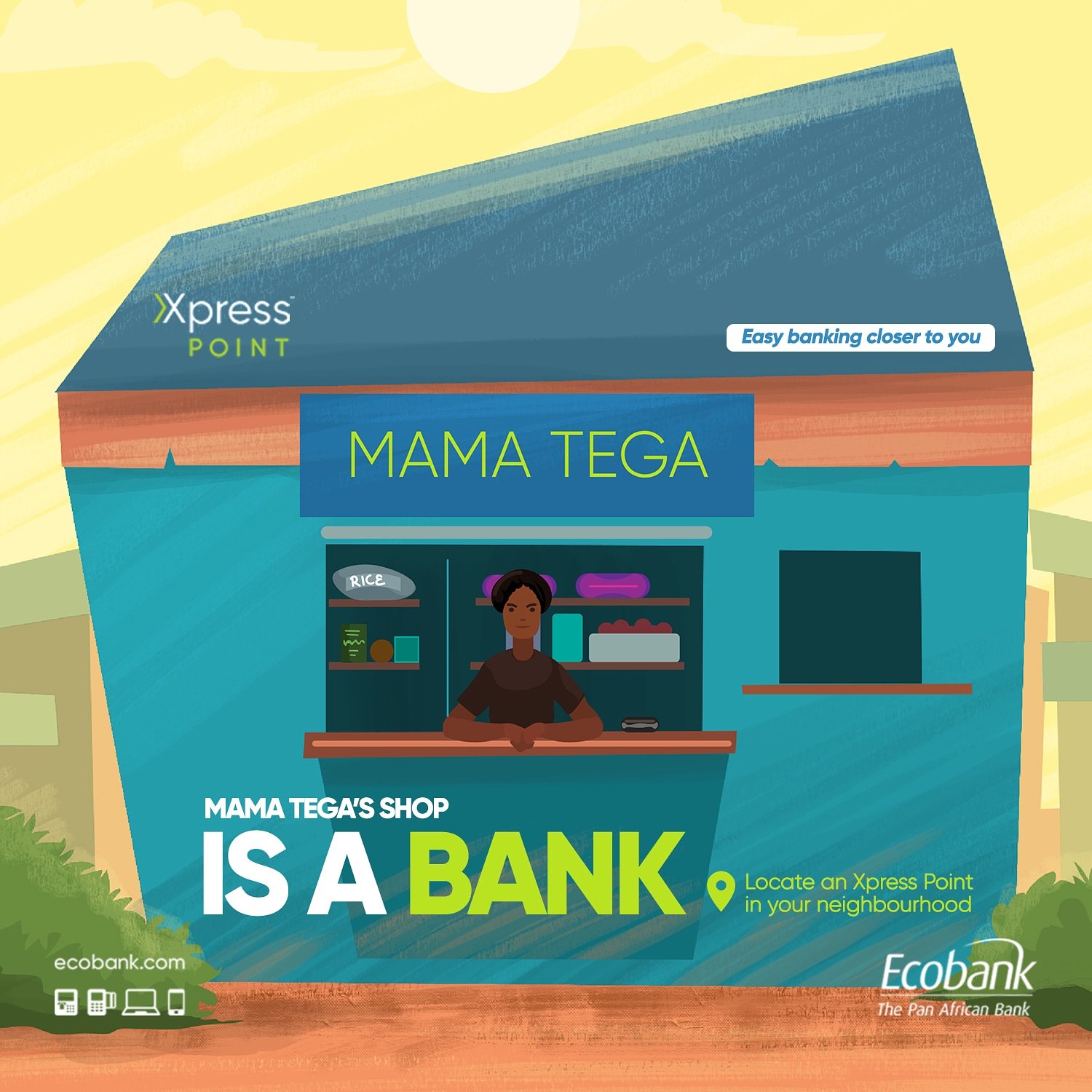

COVID-19 Rebound: Ecobank Builds Entrepreneurs, Supports Financial Inclusion Through Xpress Point Agents

Ecobank Nigeria has reiterated that its agency banking scheme, also known as Xpress Points, is building entrepreneurs and pushing financial inclusion to the large unbanked and under-banked population in Nigeria.

The Ecobank Xpress Point enables eligible Agents to carry out financial transactions on behalf of Ecobank and earn commission on every transaction processed.

The consumer experience is very good as customers can do simple deposit, payment and transfers in their own neighbourhood rather than travel for hours to a bank branch.

Ecobank Xpress Points is also a channel that can be used for the deployment of national social intervention programmes of the Government.

The aim of the Xpress Point is to let every Nigerian and household have access to Ecobank services within their neoghbourhood to provide easy banking services.

Nike Kolawole, Head, Agency Banking, Ecobank Nigeria, said unemployed and retired persons should avail themselves the opportunity to earn extra income by keying into services offered by the bank as Xpress point agents.

According to her, the Ecobank Xpress point which are in various neighbourhoods across the country, are well positioned to facilitate basic financial transactions, with the process and services simplified to attend to a broad spectrum of the society.

She further disclosed that agency banking in general, brings about economic and youth empowerment by way of job creation and earning extra income, adding that small savers can easily do their savings at home or near their home. This leads to financial inclusion of the underbanked in the country.

For now, Ecobank has over 43,000 agents across Africa.

The agents carry out financial transactions on behalf of Ecobank and earn commission per transaction processed.

Xpress Points can also be used as a channel for the deployment of national social intervention programmes, especially at this time that we are fighting the impact of lockdowns due to the COVID-19.”

Kolawole listed the services offered by the Xpress point agents as; cash in, cash out, fund transfer, bills payment, airtime recharge, remittance and account opening, among others.

She added that the services are available for “sole proprietors, partnerships, co-operative societies, microfinance banks, companies with large distribution network – like petrol stations, FMCGs, telecommunication companies, super agents, aggregators and unregistered businesses such as petty traders, hair saloon and others.”

Ecobank boasts of a bouquet of digital channels comprising solutions aimed at delivering convenient, accessible and reliable financial services.

For instance, users of the bank’s USSD code, *326# carry out transactions without paying session charges.

The USSD platform, *326#, makes it possible to open an Xpress account and Xpress Save account instantly.

The bank’s mobile banking app, Ecobank Mobile offers the option of generating a virtual card; this comes in handy as customers are continually turning to web payments for their shopping and payments.

The Ecobank virtual card offers the flexibility and convenience of creating a shopping card that is not linked to a customer’s account but is fully capable of carrying out online payments.

The virtual card can also be shared with loved ones as a gift card for their own shopping.