Financial Platform E-Wealth Connect Unveiled In Lagos State

CYRIACUS IZUEKWE

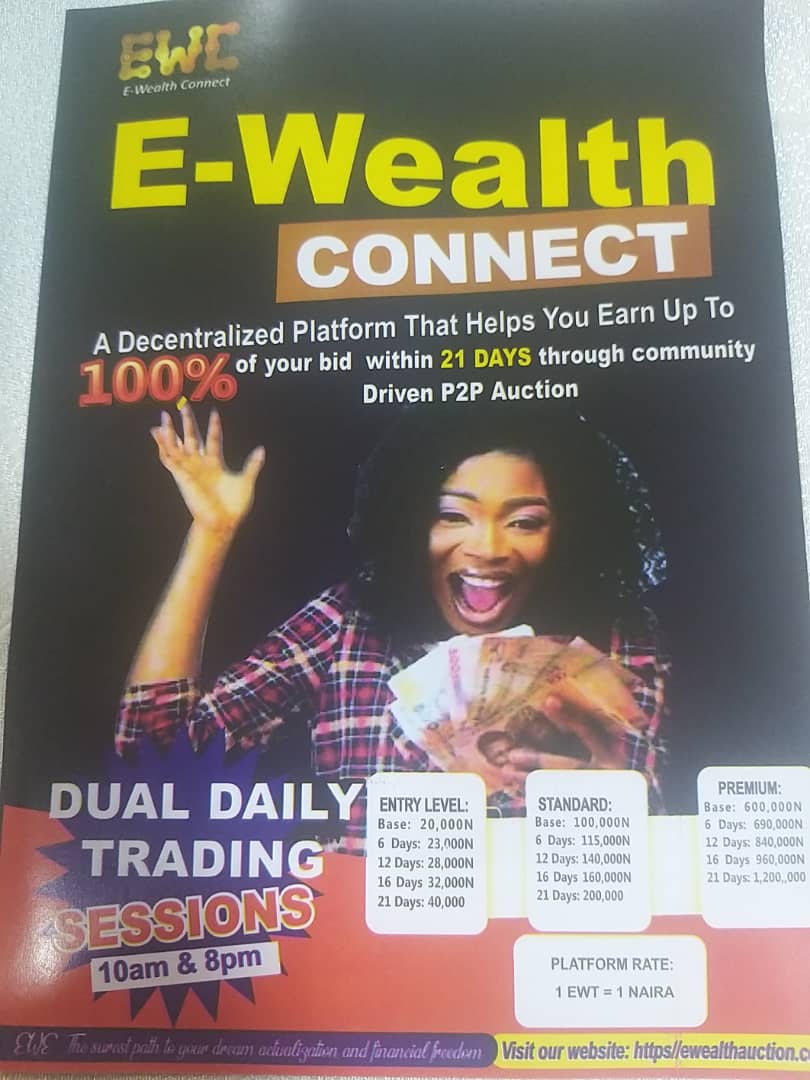

A new financial platform, E-Wealth Connect (EWC) has been unveiled in Lagos State for promotion of a decentralised, peer-to-peer (P2P) contributory system that promises financial empowerment to members.

P.M.EXPRESS reports that the platform was unveiled at St. Leo’s Catholic Church in Ikeja, Lagos.

Dignitaries from within and outside Lagos converged to witness the unveiling. Top among the dignitaries were Nollywood actors, business men and women, captains of Industry, foremost networking marketers among others.

The CEO, Madam Winner Ada Dollars, explained that the platform operates like a traditional savings model (Esusu), where members contribute funds to help each other execute business projects and receive financial support in return.

She stated that the initiative has spread to 36 states across Nigeria barely one month it was launched and it operates on a turn-by-turn model, where participants invest a minimum of ₦20,000 with substantial returns within 21 days.

Ada Dollars explained that EWC is unique and it ensures no central authority controls the funds, noting that as money moves directly between participants through a structured online platform.

How Does It Work?

“E-Wealth Connect is a community of people who have come together to change their lives collectively. It works like a contributory system, where members invest and support one another in turn. It’s a win-win—when you get connected, you win.”

“Participants are required to contribute funds, which are then rotated among members in cycles. The platform also enforces penalties for defaulters, stating that “if a member fails to contribute within 24 hours, they will be penalised with a 10% charge or risk being blocked from the system.”

Mrs Dollars stated that the platform does not operate like a Ponzi scheme as no single person holds the money. Instead, payments are made directly between participants making regulatory oversight by the CBN and SEC unnecessary. She also explained that one can withdraw money and discontinue if such person wishes or may roll over the contributions after the expiration of the mandatory day of maturity of the money.

Some of the participants spoke in the same vein. The Chairperson of Guild of Actors, Anambra State, Esther Aniegbunam, explained that the platform was created to assist the low income earners to raise money for projects within a short period.

Mrs. Gloria Jonathan, who came all the way from Abuja, noted that the platform is structured in a way for the benefit of the contributors and it is perfectly working and she has benefited since she joined the platform.