From Devaluation To Domination: How Tinubu’s Exchange Rate Reforms Turned The Naira Into Nigeria’s Export Engine

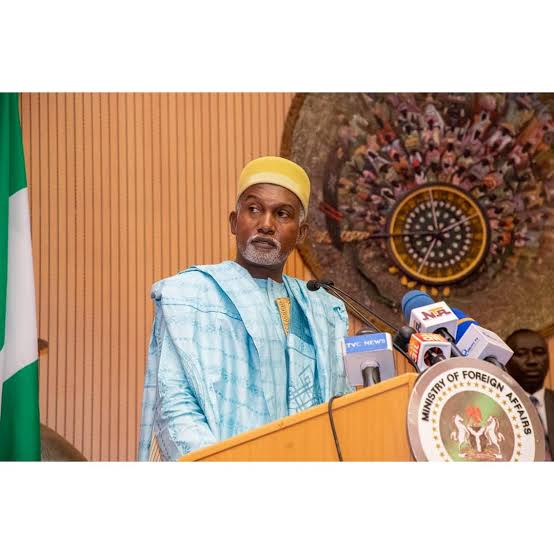

TANIMU YAKUBU

When President Bola Ahmed Tinubu’s administration dismantled Nigeria’s rigid foreign exchange regime in 2024, critics were quick to call it a currency collapse. The Naira plunged to ₦1,800 per dollar in March 2024, and headlines screamed of economic freefall. But beneath the noise, a deliberate, high-risk economic recalibration was underway—one that has now begun to pay off in spectacular fashion.

By August 2025, the Naira had clawed its way back to ₦1,525/$1, marking a 15.28% strengthening in just five months—an annualised pace of nearly 48.9%. This wasn’t luck; it was policy. Increased oil receipts, swelling diaspora remittances, and the clearing of over $4 billion in foreign exchange backlogs restored investor trust. The unification of Nigeria’s FX windows created a single, transparent market rate—finally letting the currency find its realistic value.

Why does this matter? Because a realistic exchange rate does more than please economists—it changes the very arithmetic of trade. Nigerian goods, once overpriced in dollars due to an artificially strong naira, suddenly became bargains on global markets. A bag of sesame seeds, cocoa beans, or even processed chocolate instantly cost less in New York, Mumbai, or São Paulo, without the Nigerian farmer or factory owner earning less in naira terms.

The result was swift and striking. Non-oil exports jumped from $2.696 billion in H1 2024 to $3.225 billion in H1 2025—a 19.62% year-on-year growth. And this wasn’t just a “price illusion.” Export volumes rose from 3.83 million to 4.04 million metric tonnes, proof that foreign buyers weren’t just paying more for the same goods—they were buying more goods, period.

A perfect “sweet spot” had emerged:

• For buyers abroad, Nigerian goods were cheaper than competitors’.

• For exporters at home, the naira value of earnings soared, enabling reinvestment into value-added processing—turning raw cocoa into chocolate bars, raw sesame into bottled oil.

• For the economy, the export surge pumped foreign exchange back into the system, strengthening the naira without eroding its competitiveness.

The feedback loop is textbook economics:

1. FX Reform → Realistic Naira

2. Cheaper USD Prices → Export Boom

3. Export Boom → FX Inflows

4. FX Inflows → Naira Stability

5. Naira Stability → Investor Confidence & Long-Term Growth

What’s remarkable is that this cycle feeds itself. As Nigerian goods win more market share globally, the inflow of export dollars reinforces naira stability. That stability lowers risk for investors, inviting portfolio and capital inflows that further bolster reserves.

The critics who cried “worthless naira” missed the bigger picture: a floating currency is not a sign of weakness—it is a tool for national competitiveness. By refusing to prop up the naira with scarce reserves and instead letting market forces work, the Tinubu administration has set the stage for a sustainable, export-driven growth path.

If Nigeria stays the course, the naira’s recovery won’t just be about exchange rates—it will be the story of an economy finally learning how to turn its currency into a competitive weapon on the world stage.

–Yakubu is the Director-General of

Budget Office of the Federation.