GTBank Plc Announces N93.1bn PBT In Audited H1 2021 Results

Guaranty Trust Bank Plc, now Guaranty Trust Holding Company Plc, has released its audited financial results for the period ended June 30, 2021, to the Nigerian and London Stock Exchanges.

A review of the results shows a decent performance across key financial metrics against the challenging business environment.

This performance reaffirms GTBank’s ability to cope effectively in depressed times, and as one of the most profitable and well managed financial institutions in Nigeria.

The Group reported profit before tax of ₦93.1billion, representing a dip of 15.2% compared to ₦109.7billion recorded in the corresponding period of June 2020. However, the Group’s transactional income maintained an upward trajectory as shown in fees and commission income which grew by 44.7% from ₦26.5billion in H1 2020 to ₦38.3billion in H1 2021.

The structure and earning capacity of the Group’s balance sheet remains resilient with total assets closing at ₦5.017trillion, primarily driven by a 4% increase in deposit liabilities from ₦3.611trillion in December 2020 to ₦3.755trillion in June 2021 and a slight dip in loans (net) by 1.8% from ₦1.663trillion as at December 2020 to ₦1.632trillion in June 2021.

However, the dip in profit can be attributed to the present realities of the operating environment.

Full Impact Capital Adequacy Ratio (CAR) remained very strong, closing at 24.0%, while Asset quality was sustained as NPL ratio and Cost of Risk (COR) closed at 6.0% based on IFRS (6.8% based on CBN Prudential Guidelines) and 0.27% in June 2021 to 6.4% and 1.18% in December 2020, respectively.

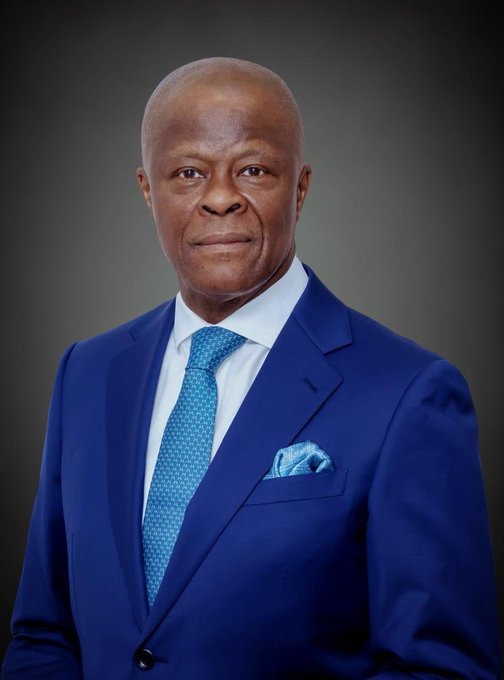

Commenting on the financials, Mr Segun Agbaje, Group Chief Executive Officer of Guaranty Trust Holding Company Plc said; “The results reflect our commitment to building on our track record of solid financial performance, and our capability to constantly innovate will ensure we stay ahead of the curve at all times. We are counting on the enduring support of our loyal customers and the hard work of our dedicated staff to continually make end-to-end financial services easily accessible to everyone and to create the best outcomes for all our customers and the communities in which we operate.”

He further stated that; “Looking forward, we are focused on bringing to bear the full benefits of our new corporate structure by consolidating our leading position in all the economies where our franchise operates. We will also diversify our earnings from core banking, continue to empower businesses across Africa and beyond, and generate long-term returns for our shareholders.”

Overall, Guaranty Trust Bank Plc continues to post one of the best metrics in the Nigerian Banking industry in terms of key financial ratios i.e. Post-Tax Return on Equity (ROAE) of 19.7%, Post-Tax Return on Assets (ROAA) of 3.2%, Full Impact Capital Adequacy Ratio (CAR) of 24.0% and Cost to Income ratio of 49.0%.

Guaranty Trust Bank Plc has been at the forefront of delivering innovative banking products and services to customers and superior Return-on-Equity (ROE) to shareholders.

It is widely regarded as the best managed financial institution in Nigeria and was recently recognized as Africa’s Best Bank and the Best Bank in Nigeria at the 2021 Euromoney Awards for Excellence.

Guaranty Trust Bank Plc also retained its position as Africa’s Most Admired Financial Services Brand in the 2021 ranking of The Brand Africa 100: Africa’s Best Brands.