Senate Passes Nigeria Insurance Industry Reform Bill 2024 For Second Reading

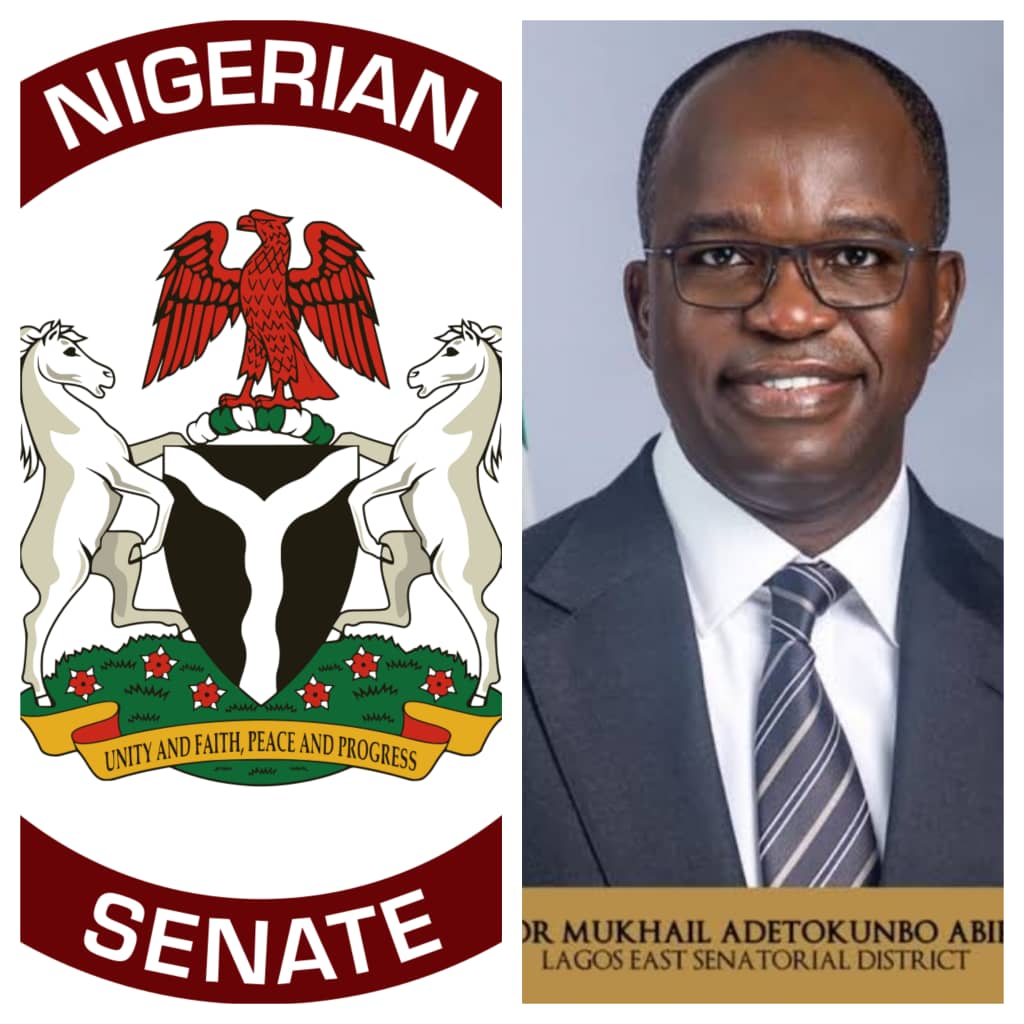

The Nigeria Insurance Industry Reform Bill, 2024 (SB 393), sponsored by the Chairman, Senate Committee on Banking, Insurance and other Financial Institutions, Senator Mukhail Adetokunbo Abiru, FCA (Lagos East), and 41 other Senators, passed second reading at the Senate on Thursday.

Senator Abiru, in his lead debate, addressed the Senate on the general principles of the bill that seeks to provide a comprehensive legal framework for the regulation and supervision of all manner of insurance businesses in Nigeria.

Speaking on the bill, Senator Abiru decried the low penetration of insurance services in Nigeria, despite being one of the oldest industries in the nation’s financial services sector.

He put the penetration rate at 0.5%, ranking 70th globally and 5th in Africa.

Abiru, an accomplished economist and accountant, who retired as a bank Chief Executive, argued further that, “With its (Nigeria’s) young and vibrant population and growing GDP, the potential for exponential growth is undeniable. However, to truly thrive in the next decade, the industry must reform in order to take advantage of the opportunities and contribute to economic growth in the country”.

In reference to the extant laws that regulate the practices of various insurance businesses, like the Insurance Act, 2003, the Marine Insurance Act, Motor Vehicles (Third Party Insurance) Act, National Insurance Corporation of Nigeria Act, and Nigeria Reinsurance Corporation Act, these laws, according to Senator Abiru, have become obsolete and ineffective in the wake of innovations and dynamics that have characterized the practices of insurance in recent time.

He highlighted the specific objectives of the bill and the general benefits to Nigerians, and the economy.

The bill consolidates various existing pieces of legislation regulating the conduct of insurance businesses in Nigeria such as the Insurance Act, 2003 the Marine Insurance Act, Motor Vehicles (Third Party Insurance) Act, National Insurance Corporation of Nigeria Act, and Nigeria Reinsurance Corporation Act.

The bill seeks to provide a robust legal and regulatory framework that will ensure that the Insurance sector contributes positively to the principal objective of the Financial System Strategy to make Nigeria Africa’s financial hub and one (1) of the twenty (20) largest economies in the world; Evolve effective risk based supervision, in the regulatory system as the existing rule based supervision, enabled by the current laws has become obsolete.

The Senators unanimously hailed the provisions of the bill and commended Senator Abiru for coming up with the well-researched and critical bill that will revolutionize the insurance sector in Nigeria.