Wema Bank Reports Profit Before Tax of ₦60.62bn, 174% YoY Growth In Q3 2024 Unaudited Results

Wema Bank Plc has released its unaudited Consolidated Financial Statements for the period ended 30 September 2024 to the Nigeria Exchange Group (NGX).

The Bank reported profit before tax of ₦60.62 billion, representing an increase of 174% over the ₦22.13 billion recorded in the corresponding period in 2023.

Wema Bank’s balance sheet remained well structured with total assets growing by 38% to ₦3,084.27 trillion in Q3 2024 from ₦2,240.06 trillion in FY 2023.

The bank also grew its deposit base year to date by 23% to ₦2,292.30 billion from ₦1,860.57 billion reported in FY 2023.

Loans and Advances grew by 25% to ₦1003.28 billion in Q3 2024 from ₦801.10 billion in FY, 2023. NPL stood at 3.19% as at Q3 2024.

The bank recorded an improved 3rd quarter performance as Gross Earnings grew by 91% to ₦288.32 billion (Q3 2023: ₦150.90 billion)). Interest Income was up 81% y/y to ₦229.11 billion (Q3 2023: ₦126.67 billion). Non-Interest Income up 144% y/y to ₦59.21 billion (Q3 2023: ₦24.23 billion).

Return on Equity (ROAE) of 38.62%, Pre-Tax Return on Assets (ROAA) of 2.64%, Capital Adequacy Ratio (CAR) of 14.06% and Cost to Income ratio of 60.47%, speak to the resilience of the brand.

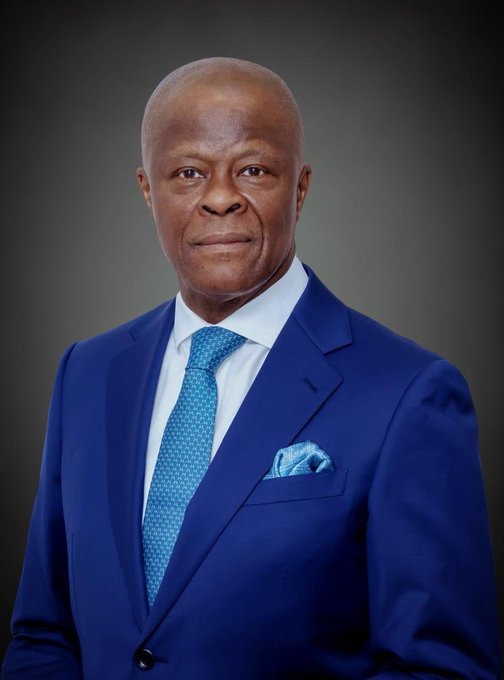

The Managing Director/Chief Executive Officer of the bank, Mr. Moruf Oseni said, “our Q3 2024 numbers speaks to our resilience despite a tough operating environment. We will sustain our growth trajectory into 2025. The performance is headlined by impressive improvements in Profit before Tax which grew strongly by 174%. The growth of Gross Earnings by 91.07%, Total Assets by 38% and earnings per share at 328.1kobo shows the core improvements to our balance sheet.

“In addition, our cost to income ratio at 60.48% has witnessed significant improvement from the previous period.”