Kuda Group CEO, Babs Ogundeyi’s Three Rules for Globalising Nigerian Fintech

How does a Nigerian startup become a global household name? It’s a question that dominates conversations in Africa’s most dynamic tech ecosystem.

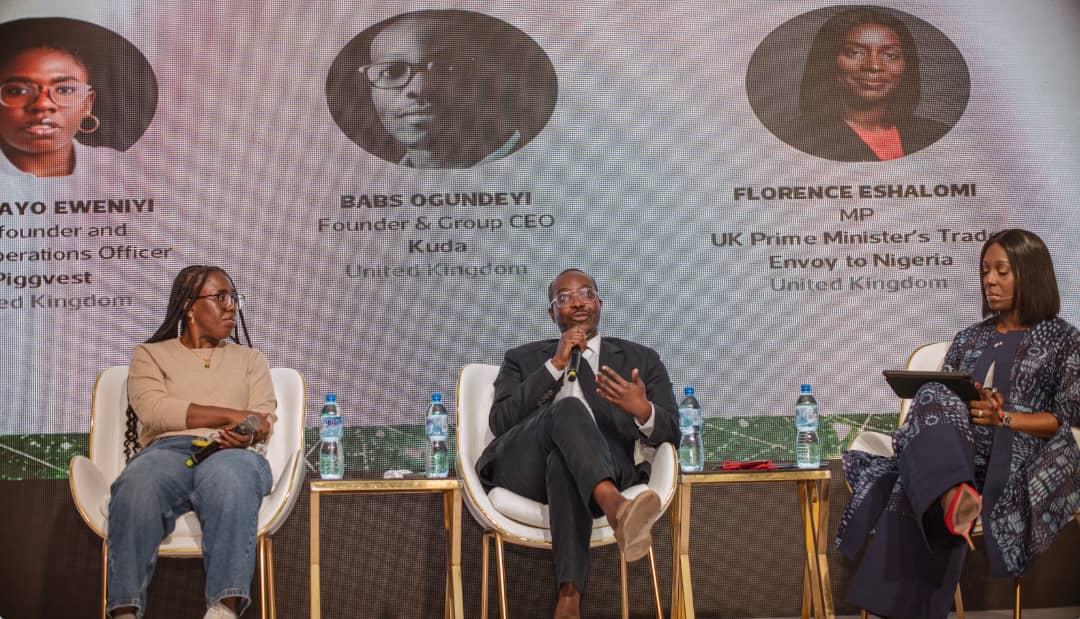

Speaking recently at the GITEX Nigeria conference, Babs Ogundeyi, Founder and Group CEO of Kuda, moved beyond the usual talk of funding and user growth to outline a clear, three-part philosophy for building an enduring, international company from Nigeria.

His vision, distilled from years of operating in both Lagos and London, offers a strategic playbook for the next generation of founders.

Here are his three core rules for globalising Nigerian fintech.

1. Treat trust as your biggest investment.

While the fintech industry often obsesses over technology, Ogundeyi argues that the real currency in a market like Nigeria is trust.

He believes the primary challenge is overcoming the inherent scepticism of a “faceless” digital service, especially when it involves people’s money. The solution is not a bigger marketing budget, but a deep, foundational investment in reliability.

“It’s really important to invest in trust as a brand. That’s probably our [Kuda’s] biggest investment,” Ogundeyi stated. This means prioritising consistency, transparent communication, and relentless customer education above all else.

In his view, the first wave of fintech was a tech race. The next is a trust race, and the winners will be those who have painstakingly built an unbreakable reputation.

2. Build a ‘London-Lagos’ bridge for credibility.

To scale globally, African startups need a playbook that addresses the realities of international capital.

For Ogundeyi, this means building a strategic bridge to a globally recognised financial hub like London. This “dual-citizenship” strategy isn’t about leaving Nigeria, but about leveraging the UK’s regulatory and financial credibility to de-risk the venture for global partners.

“Most of our investors are European, and they prefer to invest directly into the UK,” he explained. By anchoring the company’s governance and capital structure in a market with a strict, well-understood framework, founders can solve one of their biggest hurdles. This allows them to access the capital and talent needed to compete on the global stage while keeping their product engine firmly focused on the African market.

3. Export ‘Afro-tech’ like Afrobeats.

What is the goal? According to Ogundeyi, it looks a lot like the global music charts. He drew a powerful analogy between the rise of Nigerian tech and the explosion of Afrobeats, arguing that technology is Nigeria’s next great cultural export.

“We’ve been able to export our culture to a large extent. We’ve seen it in the music,” he said. The vision is for Nigerian fintech to become a household name not by imitating Silicon Valley, but by being unapologetically authentic, exporting its unique solutions, grit, and understanding of complex markets to the world.

As Nigerian firms begin acquiring UK companies, Ogundeyi is confident that this cultural and economic export is already well underway.