A Tale of Two Reforms –Why Nigeria Must Not Blink

BY O’TEGA OGRA

Economic reform is never painless. Every nation that has had to correct profound distortions has faced the same choice: take the hard medicine early, or delay and pay much more later.

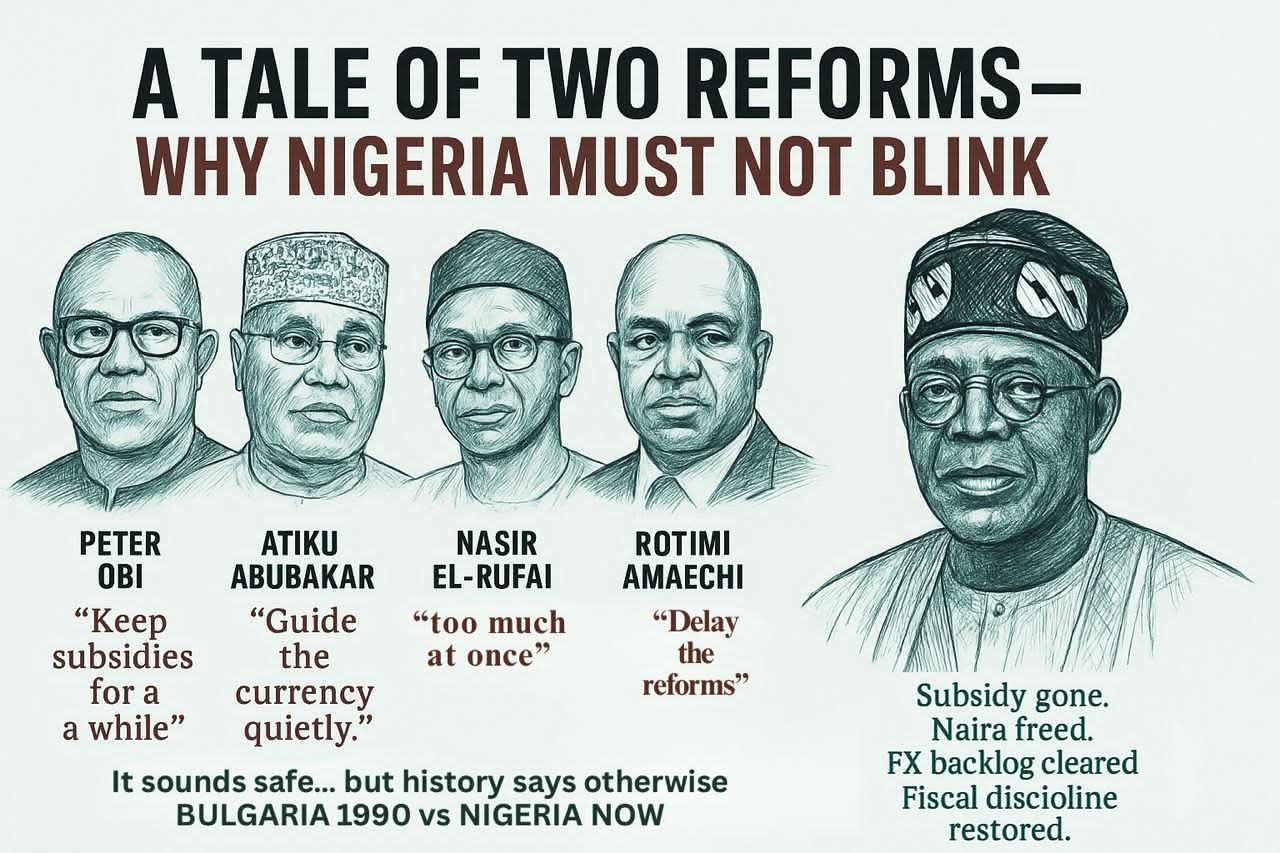

In times of public frustration, it is tempting to reach for the “gentle” option (the idea of gradual change), being pushed by some opposition elements in Nigeria, begins to sound reasonable.

Peter Obi says, “Keep subsidies for a while.” For Atiku Abubakar, it is “Guide the currency quietly from behind the curtain.” Rotimi Amaechi and Nasir El-Rufai want to “Push the tough structural work into another year.” On the surface, it feels safer. But history is clear on where that road leads.

When Bulgaria began its transition from communism in 1990, its leaders were afraid of the shock that rapid liberalisation might cause. They freed some prices but kept politically sensitive subsidies in place, just as Peter Obi proposes. The subsidies drained the treasury, fuelled inflation, and collapsed the currency. They maintained a soft peg for the lev without reserves to defend it, exactly as Atiku Abubakar suggests for the naira. The peg broke, reserves vanished, and hyperinflation soared above 2,000 percent.

They warned against “too much at once,” echoing Rotimi Amaechi and Nasir El-Rufai, and delayed the restructuring of state enterprises. Six years later, pensions were worthless, shops were empty, and the reforms they feared were forced on them in far harsher form.

Nigeria today is on a very different trajectory. From his first day in office, President Bola Ahmed Tinubu took on the biggest distortions head-on. The petrol subsidy, which drained over four trillion naira a year, is gone. The naira now trades at a market-driven rate, closing the damaging gap between official and parallel exchange rates. The Central Bank has returned to orthodox monetary policy, raised interest rates to fight inflation, and cleared more than seven billion dollars in verified FX backlogs that had become a national credibility problem. That clearance restored credibility to our financial system and prompted the International Air Transport Association to remove Nigeria from its list of countries blocking airline funds. That reversal matters because it signals to every global balance sheet that Nigeria pays its obligations again.

These decisions have delivered measurable wins in record time. The World Bank estimates subsidy savings of around two trillion naira in 2023 alone, with cumulative savings expected to exceed eleven trillion naira by 2025. This money is already being channelled into infrastructure, healthcare, and targeted social programmes across the country.

Portfolio inflows in the last quarter of 2024 hit 5.6 billion dollars, more than the total of the previous two years combined and a clear sign that rule clarity is drawing money back to local assets. Non-oil tax revenue has grown by more than twenty percent year-on-year.

Price pressure remains the public’s sharpest pain, but the first signs of relief are appearing. Official data show headline inflation eased in June 2025 from May, the first back‑to‑back moderation in many months.

Disinflation never arrives in a straight line. What matters is direction and credibility of policy. Both are moving the right way.

Yet this is the stage when voices, mostly driven by parochial interest, will call for a pause. Some will say households need breathing space and subsidies should return in another form. Others will argue that the naira is too weak and should be fixed at a stronger rate. There will be calls to slow fiscal clean-up until “conditions improve.” The bandwagon Association of Displaced Politicians, and the economists they front, want us to go back to Bulgaria 1990.

Atiku Abubakar’s “acceptable rate” is the same illusion that emptied Bulgaria’s reserves and shattered its peg. Peter Obi’s “phased removal” is the same phased lie Bulgaria told itself until the economy collapsed.

Nasir El-Rufai’s warning about “too much at once” is exactly what Bulgaria’s leaders said before the crash. Rauf Aregbesola’s “prioritise the people before the economy” mirrors Bulgaria’s fatal separation of the two, where the collapse of the economy destroyed the very livelihoods they claimed to protect –as if the economy is not the lifeline of the people. Rotimi Amaechi’s call to slow down is the same thinking that turned hardship into collapse.

These are not alternative strategies. They are invitations to failure. They are the comfort-now, crisis-later prescriptions that have failed every country that tried them. And in every country where this happened, the politicians who sold them were gone by the time the bill arrived.

The same politicians who had their turn in power and left Nigeria with a broken FX regime, ballooning subsidies, and a dangerous debt overhang now want to lecture about “protecting the people” by bringing back the very distortions that were killing growth. That is not protection. That is sabotage dressed as sympathy.

A soft peg without deep reserves burns credibility while draining scarce foreign exchange. Partial liberalisation keeps the price distortions that breed shortages and arbitrage. Delaying the clean-up of state owned enterprises only compounds losses and pushes the real costs into the future.

Once you retreat from hard reforms, investor trust evaporates, deficits swell again, and the cost of borrowing climbs. The longer you wait, the fewer options remain when the next shock comes. And when that bill finally arrives, it is always larger than it would have been if settled early.

We have seen this film before. In 1990 Bulgaria called it gradual reform. By 1996, pensions were worthless, shops and shelves were empty, and the same politicians who promised a soft landing had fled the wreckage. The dire situation in.

Bulgaria forced a desperate rescue the following year under conditions far harsher than anything they had wanted to avoid. I confidently repeat that, in Nigeria, those pushing this fantasy today will not be around to clean up the mess tomorrow. The only question is whether we have the discipline to finish the job or whether we hand the steering wheel back to the people who drove us into the ditch in the first place.

Nigeria is not Bulgaria in 1990. We will not drift toward collapse because a few familiar names prefer popularity over responsibility. The alternative is to hold the line and let the compounding work in our favour. Clean our books and keep the auction rulebook predictable. Keep subsidy savings transparent and tied to visible projects so citizens can see where the money now goes. Keep monetary policy tight until inflation is back within a credible band and do not second‑guess the float with administrative fixes that markets will immediately punish.

The IMF’s recent assessment underscored that Nigeria’s policy direction restores repayment capacity and anchors stability if pursued consistently. That is the quiet endorsement that disciplined reformers earn.

Because this debate will not end here, it is worth meeting the counter‑arguments head on. Some say the pain on households is too high and too fast. The truth is the subsidy was never free. It was paid through bad roads, weak schools, failing hospitals and heavy borrowing that our children would service. Redirected savings are how you rebuild those services. Others say the float has made the naira too weak and that we should fix it at a stronger number. A number without reserves is only a promise. Markets test promises. Bulgaria failed that test in 1990 and paid for it in 1996. Nigeria should not repeat it. Another claim is that investors are not yet flooding in, so reforms are not working. They rarely flood in at the start. They watch for consistency, then move quickly. The late‑2024 surge in portfolio inflows is exactly that early signal. Hold the line and the longer term money follows.

But as Mr President has always said and I am fully aware, Nigeria’s path is not without discomfort, but it is the only one that gives us a fighting chance to rebuild. The facts of upward, positive change are not in dispute. It is already producing the first signs of stability and renewed investor interest. The trajectory, if we hold it, leads to a competitive and credible naira, a fiscally stronger state investing in power, roads, and schools instead of fuelling petrol imports, and an economy where capital flows in because the rules are predictable and the numbers add up. Growth will no longer be hostage to oil prices alone, and the non-oil revenue gains of the current and past year are the proof.

The opposition has shown that they have chosen collapse. Some former allies have joined them. The rest of us must hold the line. History has already written the ending for the road they want. We have chosen a different ending.

There is no painless exit from decades of distortion. The choice is as stark as it is simple. Pain now with a recovery you can see, or comfort now with a collapse you cannot control.

Bulgaria 1990 is the warning. Nigeria 2023 is the opportunity. We are already making in months the progress that took years for countries in similar positions. If we keep our nerve, stay transparent, and refuse the detours that have failed elsewhere, we will not just avoid Bulgaria’s trap. We will write the modern African recovery story others will study.

And this is the truth we must hold to. The easy road has never led any nation to greatness. What we are doing under President Bola Ahmed Tinubu is hard, but it is necessary. We will be judged not by how loud the complaints were in the first year, but by the strength of our economy in the fifth and thereafter. If we see this through, the same Nigerians who today feel the sting will one day stand as proof that under President Bola Ahmed Tinubu, Nigeria chose courage over comfort, and that choice changed the destiny of our nation for good and forever. And if we have the discipline to finish this path, it will be the one in which Nigeria wins.

The Tiger’s Final Take: The Koko of the Matter

Bulgaria’s 1990 reforms teach us that gradualism in the face of structural crisis is not kindness. it is negligence in slow motion.

Nigeria’s current path under President Tinubu is the opposite. It is tough, urgent, and forward-looking. If we hold this line, the discomfort will give way to resilience, competitiveness, and prosperity.

Nigeria’s reforms today are closer to Bulgaria’s 1997 reset which is the one that finally worked, rather than to its failed 1990s drift. The difference is that Nigeria is doing it before hitting hyperinflation or a currency collapse.

It is the hard road, but it is the right road, and it leads upward. This is the best time to Bet on Nigeria.

-Ogra is the Senior Special Assistant to President Tinubu on Digital Communications, Engagement, and Strategy