EXPOSED! P&ID $9.6bn Judgement: TY Danjuma Connection

FUNSHO AROGUNDADE

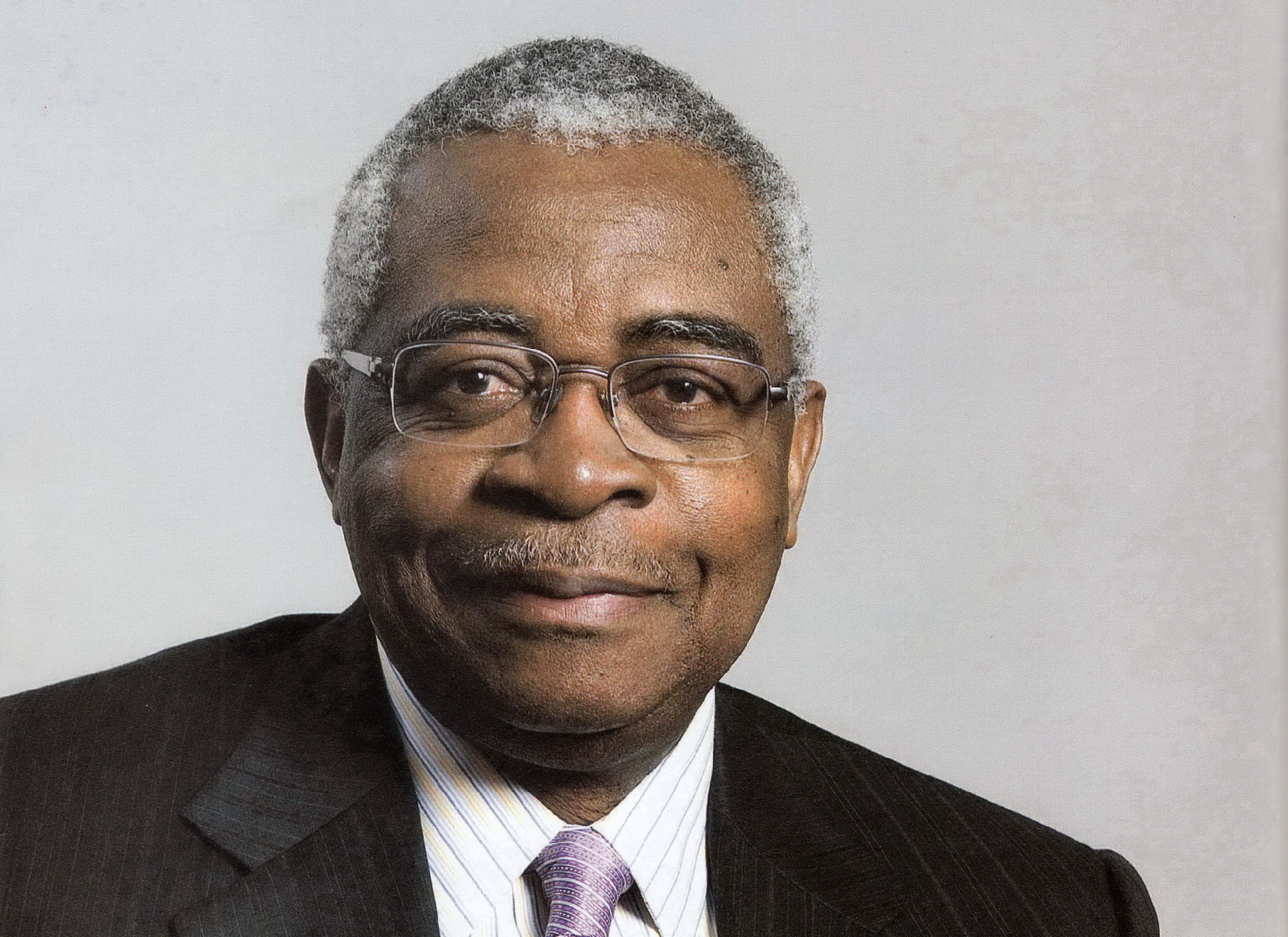

A latest report by the Bloomberg Businessweek has revealed that the original idea for the controversial Process and Industrial Developments Limited, P&ID’s failed 2010 Gas Supply and Processing Agreement was that of Nigerian billionaire and former General, Theophilus Yakubu Danjuma.

In an interview with Businessweek, the 81-year-old Danjuma expressed doubts on the claims by the Irish firm, saying the gas flaring project was originally his idea, and that one of his companies, Tita-Kuru Petrochemicals Ltd., had spent the $40 million preparing it, not Michael Quinn, founder of P&ID Limited.

The agreement provided for P&ID to build facilities in Odukpani, Cross River State to refine associated natural gas to be used in generating electricity.

P&ID claims that Nigeria was to supply it with fixed quantities of wet gas over a 20-year period. In return for supplying lean gas to the state, P&ID would be allowed to retain natural gas liquids separated during the refinement process and sell them for its own profit.

P&ID claims it invested about $40 million in the project but that the facilities were never built and no wet gas was ever delivered.

P&ID alleged that Nigeria failed to meet its obligations to supply wet gas or complete construction of a pipeline that was necessary to transport the wet gas to the project site.

The company said these failures led to the project’s collapse, costing it 20 years’ profits from the sale of natural gas liquids (NGLs).

But according to the Taraba-born oil tycoon, the late Irishman had been a consultant to him, using his funds and office space.

The General, it was said became upset upon discovery that Quinn applied for the contract himself.

The realization dawned, he said, that “my consultant was going to steal my project.”

Danjuma recalled being promised a share of P&ID in return for his initial investment, but added that he hadn’t heard from the company in years.

At one point, Danjuma dusted off his hands to emphasize the relationship’s end.

P&ID’s spokesperson declined to comment on Danjuma’s involvement or any other matters raised in this story.

P&ID had filed a petition against Nigeria before the United States District Court, Washington DC, to confirm a ‘final award’ dated 31 January 2017.

But after a set of closed legal proceedings, a UK Tribunal judges awarded P&ID $6.6 billion, one of the biggest amounts a company has won from a sovereign state.

Read the entire article below:

Is One of the World’s Biggest Lawsuits Built on a Sham?

A dying Irishman went for one last big score in Nigeria. The project failed, but a London tribunal says his company’s owed $9 billion and counting.

Gaslighting

The oilfield fires of the Niger Delta burn day and night. Metal pipes snake through the swampland, spewing flames so vast they cast the sky in apocalyptic orange. Southern Nigeria sits atop a bubbling stew of oil and gas. Companies want only the former, so they incinerate the latter. The industry calls it “flaring.”

For millions of Nigerians, flaring is a curse. It fills the air with toxic fumes that cause respiratory disease and cancer and later fall as acid rain, which damages homes and crops. It also wastes vast amounts of energy in a region where many villages lack electricity and cities suffer daily blackouts.

In 2008 the Nigerian government said it would end flaring by using oilfield gas to generate electricity. The minister of petroleum resources acknowledged that the challenge would be “enormous.” Converting gas requires it to be captured, transported, refined, and piped back to power plants and onto the grid.

Officials struggled to persuade big multinationals to invest in the required infrastructure, so concessions were granted to 13 smaller companies, some virtually unknown.

One was Process and Industrial Developments Ltd., or P&ID, which was registered in the British Virgin Islands but had no website or track record. Its chairman was Michael “Mick” Quinn, a 68-year-old Irishman with a rakish mustache and decades of experience in Nigeria, mostly as a military contractor.

Quinn knew powerful people, including the petroleum minister, who guaranteed P&ID a 20-year supply of “wet,” or unrefined, gas for a plant the company would build. The raw material would be supplied for free, to be treated and returned at no cost. P&ID would instead profit from the byproducts, butane and propane. Everyone stood to benefit, not least the villagers whose homes would be lit by electricity rather than the wan glow of flaming methane.

Then the plan fell apart. The government failed to secure any waste gas from oil companies, let alone link up the necessary pipeline, and the plant was never built. In 2012, P&ID notified the oil ministry that it was suing for breach of contract in a London arbitration forum. After a set of closed legal proceedings, judges awarded P&ID $6.6 billion, one of the biggest amounts a company has won from a sovereign state. When Nigeria dragged its feet on payment, P&ID teamed up with a hedge fund and moved the case to public courts, where it could ask judges to seize state assets, including bank accounts and cargo ships.

In the summer of 2018, a man who’d worked for Quinn contacted Joseph Pizzurro, a veteran New York lawyer hired by Nigeria to lead its defense in the U.S. The caller wanted to talk about the P&ID case. “I don’t think it’s genuine,” the man said, according to an account he gave Bloomberg Businessweek on condition of anonymity because he feared for his safety. He told Pizzurro that Quinn had conspired with officials to profit from government projects that were doomed from the start and that P&ID was one of at least three such lawsuits involving Quinn. The caller couldn’t provide enough evidence to substantiate his claims, though, and he didn’t contact Pizzurro again.

This August, P&ID won a ruling from a London judge allowing the firm to start seizing Nigerian assets. Hailed as a vindication by Quinn’s company, it caused an outcry in Nigeria. The country’s finance minister said at a press conference that the size of the award, which has risen above $9 billion with interest, meant all Nigerians would pay a price. The chair of the central bank said that the case has affected monetary policy. Toward the end of the month, the justice ministry opened a corruption investigation into how the gas plant deal was struck. “The contract was designed to fail right from inception,” attorney general Abubakar Malami told reporters. If the Nigerian government is right, P&ID was an audacious scheme that had made unwitting accomplices of legal professionals, financial institutions, and politicians around the world.

The company and its founders remain elusive. A Nigerian newspaper recently published a list of unanswered questions about the firm: Where are its offices? How many people does it employ? How did such a tiny company win such a large concession? Quinn isn’t around to answer them; he died of cancer in 2015. But a close examination of his career, drawn from public records, leaked documents, and interviews with friends and former associates, shows that P&ID wasn’t the only Quinn project to end in disappointment, lawsuits, and corruption allegations. It was just the largest—the one that was supposed to provide his biggest payday.

Man in Mohair

Quinn grew up in Drimnagh, a tough neighborhood in Dublin. After leaving school as a teenager in the 1950s, he trained as a mechanic. An ordinary blue-collar life might have beckoned had one of his neighbors not started a show band, the Royal Olympics. These groups were unique to ’60s and ’70s Ireland: shiny-suited young men playing rock ’n’ roll or jazz, perpetually touring church halls and farm sheds to earn shoeboxes full of cash.

The Olympics needed a manager, and soon Quinn had a new career as one of the natty, ruthless handlers a BBC documentary labeled “men in mohair suits.” He ran some top acts: Daddy Cool & the Lollipops, Twink, Dickie Rock. An old friend recalls that he’d approach a singer and say, “How much are you earning? One hundred pounds a gig? I can get you 1,000.”

Quinn stuck with the industry for a while after the show bands’ popularity declined—newspaper reports suggest he arranged an Irish tour by Diana Ross and the Supremes—but there was more money to be made elsewhere. At some point in the ’70s he started working in Nigeria, either as an oil trader or a financier of cement deals, depending on which of the scattered accounts of his life you believe. He began profiting from a construction boom taking place in Lagos, which was then expanding with such chaotic abandon that hundreds of cement-bearing cargo ships were lined up at port waiting to dock.

He kept working in Ireland, too. In 1979 he and a partner, Brendan Cahill, formed an umbrella company with the resolutely dull name Industrial Consultants (International) to oversee their interests. They began working with the government, for example getting a public grant worth $450,000 to start a videocassette factory near Dublin. The project went bust within two years.

Quinn’s business drew on some powerful allies dating to his show band days. One of the closest was Albert Reynolds, a former music hall impresario who was elected to Parliament in 1977 and became prime minister in 1992. Two years after being elected PM, Reynolds was promoting Kent Steel, one of Quinn’s companies, as a potential savior of Irish industry. Kent had recently won 3 million Irish pounds (about $4.3 million at the time) from the European Union to explore cleaner technology for making steel—potentially a huge boon. Instead, the project produced nothing but some sketches and a bunch of debris.

Joe McCartin, then a member of the European Parliament, says he raised concerns with an EU official that the deal was a scam and was told, “Don’t worry. Your prime minister, Albert Reynolds, knows all about the project.” The EU did eventually start a probe into the grant, and McCartin, who’s now retired, says its investigators showed him a letter from Irish prosecutors relaying that a fraud had been committed but that they couldn’t identify the perpetrators. The probe was eventually closed without penalty; the EU refused to fulfill a freedom of information request about the case, citing privacy rules. Reynolds passed away in 2014.

Quinn’s name came up again during a nationwide corruption inquiry in Ireland. The Mahon Tribunal, as it was eventually known, lasted for 14 years, compiling evidence of graft on an epic scale. Quinn was called as a witness in June 2007, one of the few times he ever spoke on the record. The tribunal wanted to know more about relationships Industrial Consultants had with Frank Dunlop, a shady lobbyist, and Liam Lawlor, a corrupt Republican MP who’d resigned in disgrace before being killed in a 2005 car crash outside Moscow.

Quinn denied knowledge of invoices that bore his company’s name—payments for golf fundraisers, he guessed—and said he thought his signature had been forged on checks. He had no recollection of many of his dealings with Dunlop. “You are a singularly unhelpful witness,” Alan Mahon, the presiding judge, told him. “What you are telling us is nothing, absolutely nothing.” The tribunal later found that tens of thousands of pounds had flowed from Quinn’s companies to Lawlor, but Quinn wasn’t recalled to the stand, and neither he nor Industrial Consultants faced any action.

By then, Quinn had developed a fearsome reputation. Several former associates told Businessweek they were scared to speak on the record about him, because they believed he had ties to Irish paramilitaries; one said Quinn told him his father had been in the original Irish Republican Army in the 1920s. Employees introduced him as “the chairman,” and he employed a man with a pugilist’s squashed nose to drive guests around Dublin, apparently without great regard for red lights. A former Quinn associate says that when Quinn’s daughter ended a brief marriage to David Boreanaz, an American actor best known for roles on Buffy the Vampire Slayer and Angel, Boreanaz called Quinn to make sure there was no bad blood between them. Boreanaz’s manager didn’t respond to requests for comment.

The Trouble With Nigeria

Throughout the 2000s, Quinn lived a kind of double life, divided between Nigeria and a comfortable suburban house near Dublin. At home he was Mick from Drimnagh, living with his wife, Anita, who’d been his childhood sweetheart, and their two Doberman pinschers. On Tuesday nights he’d drop Anita off at bingo, then pick up fish and chips for dinner.

Life in Nigeria was very different. The country’s freewheeling capitalism was fraught with risk and opportunity. The writer Chinua Achebe detailed the climate in his 1983 polemic The Trouble With Nigeria: Contracts with the military government were currency, doled out by senior politicians to allies and friends as the public bore the burden of hidden kickbacks, inflated prices, and stolen materials. Military rule ended in 1999, but democratic Nigeria was proving just as restive and complex. There were tribal uprisings in the Niger Delta and kidnappings and religious conflict elsewhere.

Quinn nevertheless thrived, befriending presidents and civil servants alike. He and Cahill used a company called Marshpearl to bid for lucrative military contracts, initially registering the name in Ireland, then in 1999 using the Panama-based law firm Mossack Fonseca & Co. to create Marshpearl Ltd. in the British Virgin Islands. To the outside world, the BVI company was practically untraceable. Mossack Fonseca documents leaked to the newspaper Süddeutsche Zeitung and made available to Businessweek by the International Consortium of Investigative Journalists show that Marshpearl Ltd.’s directors were nominees, paper executives whose sole job was to sign documents. (Reached by phone, one of them, Nigel John Carter, a Geneva-based trusts specialist who was also a director of another Quinn BVI vehicle called Kristholm Ltd., said, “I’ve never heard of those two companies.”)

Marshpearl sponsored a local polo team, giving Quinn an excuse to mix with the Nigerian ruling classes. His sons attended elite private schools with the sons of politicians and generals, who asked Quinn to help them acquire helicopters, Japanese motorcycles, and more. On the golf course back in Ireland, friends recall, Quinn would pick up the phone to talk to various officials or military leaders. “Did you get them guns?” one friend remembers him asking in his distinctive Drimnagh drawl. His golf buddies were never sure if he was joking. His contacts included Theophilus Danjuma, who’d risen to prominence in the ’60s by leading a bloody coup against Nigeria’s military ruler. Danjuma went on to become a general, then entered business and eventually politics, ascending to defense minister in 1999. He later sold a stake in a Nigerian oil field to a Chinese state company, helping make him a billionaire.

One of the few people who would speak on the record about Quinn’s life in Nigeria is Neil Murray, a friend of 30 years who was involved in several Quinn projects there. Sitting one night at the Abuja Hilton piano bar, a favorite haunt, Murray wasn’t hard to spot: a gray-haired figure so hunched over he was bent almost double, puffing cigarettes and chatting with businessmen and prostitutes, who called him Papa. After initially accusing a Businessweek reporter of being a spy for the Nigerian government, he agreed to talk. “Mick knew Obasanjo. He knew Yar’Adua,” Murray said, referring to former presidents Olusegun Obasanjo and Umaru Musa Yar’Adua. “He knew everyone.”

Among the projects Murray was involved in was a contract to repair and upgrade 36 British-made Scorpion tanks at an abandoned plant at Bauchi, in the dusty heart of Nigeria. It had all the hallmarks of Quinn’s deals in the country: complexity, misdirection, and a substantial payday for the middleman. “There was a subsequent contract, and a subsequent contract, and a subsequent contract,” Murray said. “It was an ongoing process.” Quinn personally recruited military experts to manage the work and find replacement parts. At one point, Danjuma visited the site.

Several people involved in the venture described each vehicle as an opportunity for profit. Petrol engines were replaced with diesel engines. New radios were installed. When faulty valves needed replacing, one former employee said, he found a British supplier for a few pounds a unit. “Too cheap,” he remembered Quinn telling him. They found costlier valves elsewhere. The more expensive the new part, the bigger Marshpearl’s cut.

A memo viewed by Businessweek that circulated among Quinn’s team noted that Marshpearl had charged the Nigerian army for undelivered tank parts, making his organization “vulnerable.” But the company kept winning contracts, in spite of this hitch and others. It’s not clear how many millions of dollars Nigeria spent on the Bauchi project, but the relationship likely made Quinn a fortune.

For one contract, a spinoff from the main deal, his company sought to supply about 4,000 rounds of tank ammunition made by Belgian defense company Mecar SA. A January 2005 memo outlining Marshpearl’s plan says Quinn’s staff told Mecar they would handle bidding, contracts, and billing. Mecar’s managers “do not want to know the details as they would be embarrassed with Belgian authorities and U.S. owners,” the memo said.

The blueprint called for Marshpearl to establish a company called Mecar SA, register it in Cyprus, and open a bank account for the new offshore entity to avoid Nigerian taxes on the income. The original Mecar would write up a bid for the contract and send it to Marshpearl, where the document would be scanned and altered to increase its value by 20%—commission for Quinn and his friends. Payment to the original Mecar would be routed through the offshore one. All documentation was to be delivered by hand.

The “paper trail” was Marshpearl’s greatest area of concern, the memo’s author wrote, without explaining why. Broadly speaking, while offshore companies have legitimate purposes, they’re also favored by those trying to avoid tax or government scrutiny or hide illicit income. In some jurisdictions, secrecy laws make it virtually impossible to find out who owns them. Registering a company with a virtually identical name to a separate, legitimate business would have the effect of further obscuring the real beneficiaries.

To a watchdog or another outside observer, the Mecar arrangement would look like a simple transaction between a respected manufacturer and the army, with the middleman getting its cut. A tender bid document sent by the offshore Mecar to the Ministry of Defense a few months after the memo’s date placed the contract’s ultimate value at €4.9 million ($5.6 million), meaning Marshpearl would have made almost a million euros.

Shown the memo at the Hilton bar, Murray said, “Very clever.” He didn’t see anything improper in the deal’s structure but added, “I wasn’t directly involved.” A spokesman for Mecar’s current owner, Nexter Group, said the Marshpearl deal took place before it acquired the company in 2014 and that it complies with rules and regulations.

The Art of the Failed Deal

It’s said that in Nigeria you can go from pauper to millionaire overnight and back again just as quickly. Even old hands could be caught out by a sudden shift in the political climate, as Quinn was in October 2006. That month, he was charged with espionage and handling secret military materials, alongside his son Adam, a close associate from Ireland named James Nolan, three Nigerian officials, and three individuals from Israel, Romania, and Russia. Details are sketchy, but one of the Nigerian officials submitted an affidavit saying the indictment was over a “large scale of contract scam which involves very senior officers of the Ministry.” Nolan and Adam Quinn didn’t respond to requests from Businessweek for comment, but they denied the charges at the time. The prosecution appears to have been dropped within a year. A defense lawyer involved with the case recalls that the government intervened.”

That same year, Quinn formed P&ID and began exploring opportunities in gas power. He also branched out into medical technology. In 2006, more people were living with HIV/AIDS in Nigeria than in any country but South Africa or India. The Nigerian health ministry’s efforts to tackle the crisis included a multimillion-dollar partnership with Dublin-based Trinity Biotech Plc to supply HIV testing kits and help set up a factory at the Sheda Science & Technology Complex, which was being constructed outside Abuja. The contract for the factory went to an entity called Trinitron, which local media assumed was a subsidiary of the similarly named Irish company. In fact, it had no formal connection to Trinity Biotech of Dublin and was jointly owned by the health ministry and a group of Irish and Nigerian businessmen. Trinitron’s Irish directors included Adam Quinn and James Nolan, according to three people familiar with the deal. Quinn’s firm Industrial Consultants became a shareholder.

A few years into the contract, Trinity discovered that Trinitron had registered a company called Trinity Biotech Nigeria domestically and another called Trinity Biotech Joint Venture in the British Virgin Islands. Executives from the original Trinity were furious when they learned of the clones. In 2008 and 2009, they pulled out of the project entirely.

“Trinity Biotech had no ownership stake in Trinitron or the Sheda project or in any entity or assets within Nigeria,” the Dublin company said in a statement to Businessweek. “Our role in the project was the provision of HIV test kits, which we did, although we were left with a significant unpaid debt when the project ended.” Eventually, government funding dried up, and, according to two sources, Trinitron was reported to local police for allegedly misspending state funds, though no one was charged.

Gerry Nash, Trinitron’s former project director, said in a statement that test kit production at the factory in Nigeria hadn’t progressed because the health ministry wouldn’t buy the kits locally. “People in the Nigerian Ministries were more interested in picking up commissions on imported products,” he wrote. He said that Trinitron had succeeded in developing an IT system and in training HIV specialists, and he denied that the venture was a failure overall, even though the Sheda factory wound down after a few years.

Today, the Sheda site outside Abuja is overgrown with weeds. A pockmarked sign outside the front gate attests that Trinitron once operated there, but none of the buildings look functional. Gravel piles dot the parking lots. The handful of bored security guards and administrative staff on-site say only that Trinitron is no longer there.

When it wasn’t possible to squeeze profit directly from a floundering project, Quinn could enlist the law for the purpose. In 2010, Industrial Consultants brokered a $5 million deal with the Nigerian Air Force to repair ejector seats in six Alpha Jets, small fighter craft often used to train pilots. A British company called North Wales Military Aviation Services Ltd. would do the fixing.

A few months into the contract, the air force terminated it for no apparent reason. The ensuing dispute ended up before a Nigerian arbitration panel, which found that the military had pulled out for “flimsy, untenable, and unacceptable reasons.” It awarded NWMAS about $2.3 million for work allegedly done, plus interest, according to a copy of the private judgment seen by Businessweek.

The case was straightforward enough, apart from one detail: NWMAS didn’t know about any of it. In a statement, the company said its executives had hosted Nigerian officials but never got word it had won the job. Instead, a few months after the visit, it received a letter saying the air force was suing for nonperformance. NWMAS managers forwarded the letter to Quinn’s team and heard nothing further on the matter until being contacted by Businessweek earlier this year.

If NWMAS didn’t participate in the lawsuit, who did? Individuals from the Quinn organization. Long before the ejector seat contract was finalized, unbeknownst to the original company, Quinn’s team had registered a local entity called NWMAS Nigeria Ltd.—another clone.

Murray testified at the arbitration on behalf of NWMAS. “They never f—king paid,” he told Businessweek, referring to the Nigerian air force. He said the British NWMAS had been fully aware of the case and that NWMAS Nigeria had been created to comply with local regulations.

Quinn’s organization apparently had trouble collecting the award. In 2013, Cahill sent a message to colleagues about the struggle to enforce the judgment in Nigeria’s chaotic courts. “The moral of the story is that ideally the ‘seat’ of arbitration should be outside of Nigeria and preferably in London,” he wrote.

Quinn and Cahill already had a stake in at least two lawsuits against Nigeria before the British courts. One of the cases relates to IPCO (Nigeria) Ltd., formerly part of Singapore-based construction group IPCO International Ltd. The parent company sold most of its stake in 2003, leaving behind a shell company whose sole activity seems to have been to engage in lawsuits—notably a $150 million case against the Nigerian petroleum ministry over delays to the construction of an oil terminal. There were familiar allegations of overcharging, and the suit went all the way to the U.K. Supreme Court before being settled on confidential terms last year. How much IPCO Nigeria’s owners received and who benefited remains a mystery. You won’t find Quinn’s or Cahill’s name in the countless claims, counterclaims, and rulings produced since the case began more than a decade ago, but according to three people familiar with Cahill’s role, he helped manage the U.K. lawsuit for IPCO Nigeria in return for a share of the proceeds. The company’s director, Olu Adewunmi, declined to comment on whether Cahill was involved in the lawsuit.

The Big One

The other case, of course, was P&ID. Nigeria’s desire to end flaring and provide power to the troubled Niger Delta had offered Quinn, almost 70 and in poor health, an opportunity to secure his legacy. “Mick was sick,” Murray said. “He wanted to go out on a big one.”

In 2012, once it had grown obvious the gas project wouldn’t come off, P&ID invoked its right to take Nigeria to arbitration in London. Three judges, two Brits and a Nigerian, oversaw the proceedings. From the start, Nigeria’s government seemed reluctant to participate. Its lawyers in Lagos didn’t provide a list of preliminary arguments until January 2014. Later that year, a few weeks before the first scheduled hearing, they told the tribunal they might not be able to set out the government’s case in writing or attend, “due to the inability of our client to provide us with complete instructions.”

P&ID’s submissions included a lengthy witness statement from Quinn, one of his last public declarations before he died. He described spending two years and an estimated $40 million on preparatory work for the gas plant, including a 3D digital model. “I cannot say with any certainty why the government failed to honour the GSPA,” Quinn wrote of the gas sale and purchase agreement. He suspected pressure from international oil companies was to blame. “In any event, I very much regret that we were prevented from implementing the GSPA, which I firmly believe would have been of significant benefit to the nation.” In outlining his history in Nigeria, he didn’t mention any of his military deals, the espionage charge, or the two other lawsuits against the country.

The Big One

The other case, of course, was P&ID. Nigeria’s desire to end flaring and provide power to the troubled Niger Delta had offered Quinn, almost 70 and in poor health, an opportunity to secure his legacy. “Mick was sick,” Murray said. “He wanted to go out on a big one.”

In 2012, once it had grown obvious the gas project wouldn’t come off, P&ID invoked its right to take Nigeria to arbitration in London. Three judges, two Brits and a Nigerian, oversaw the proceedings. From the start, Nigeria’s government seemed reluctant to participate. Its lawyers in Lagos didn’t provide a list of preliminary arguments until January 2014. Later that year, a few weeks before the first scheduled hearing, they told the tribunal they might not be able to set out the government’s case in writing or attend, “due to the inability of our client to provide us with complete instructions.”

P&ID’s submissions included a lengthy witness statement from Quinn, one of his last public declarations before he died. He described spending two years and an estimated $40 million on preparatory work for the gas plant, including a 3D digital model. “I cannot say with any certainty why the government failed to honour the GSPA,” Quinn wrote of the gas sale and purchase agreement. He suspected pressure from international oil companies was to blame. “In any event, I very much regret that we were prevented from implementing the GSPA, which I firmly believe would have been of significant benefit to the nation.” In outlining his history in Nigeria, he didn’t mention any of his military deals, the espionage charge, or the two other lawsuits against the country.

On the basis of largely unchallenged evidence provided by P&ID, the judges dismissed Nigeria’s objections and proceeded to the next stage: damages.

According to the Abuja-based Premium Times, Quinn’s company agreed to settle for $850 million, but the government of President Muhammadu Buhari, who’d taken office in May 2015, rejected the deal. When the tribunal convened a hearing on the matter, Nigeria called only one witness—a lawyer who, in the words of the judges, didn’t “claim firsthand knowledge of any of the relevant events.” In January 2017 they awarded P&ID the profits they calculated it had missed out on because the plant wasn’t built: $6.6 billion, more than three times its original estimate of losses.

A ruling in London didn’t guarantee payment, though. P&ID’s lawyers took the judgment to several hedge funds that specialize in wringing cash from bad debts, according to someone familiar with the conversations. Records show they found at least one taker: VR Capital Group Ltd., a fund manager with offices in London, New York, and Moscow.

VR acquired one quarter of P&ID—which really meant, because the only thing of value P&ID possesses is a favorable legal ruling, that it was buying a share of the suit’s proceeds, presumably in return for helping finance the legal action. (Reached by phone, VR Capital President Richard Deitz said, “No. Can’t talk. I’m busy,” then hung up. The company didn’t respond to an emailed request for comment.) The remainder of P&ID is held by Cayman Islands-based Lismore Capital Ltd., whose ultimate owners are unknown. If the Nigerian government ever pays up, it will be impossible to know who benefits.

Last October law firm Kobre & Kim and public-relations specialist DCI Group registered with the U.S. Senate to lobby on behalf of P&ID. Op-eds critical of Nigeria soon appeared in Forbes and the Daily Telegraph, urging its government to honor the judgment; another, authored in London’s City A.M. newspaper by Priti Patel, a former British secretary of state for international development, accused the country of flouting international law. Journalists also began receiving messages from a group called P&ID Facts, whose emails list the same address as that of DCI Group. “The founders of P&ID have a track record of delivering in Nigeria and for Nigerians,” the organization’s website says. “The P&ID project was to be their swan song project after over three decades of public works projects in the country.”

Nigeria’s president thus far appears unmoved. A former general who styles himself as a simple cattle farmer and anticorruption crusader, Buhari has a relatively clean reputation. He responded angrily to Patel, issuing a statement through his spokesman that echoed what Pizzurro’s whistleblower had said: The P&ID lawsuit wasn’t what it appeared to be. “Before the coming of the Buhari administration, there existed in the country a racket encompassing elements in the three arms of government, the executive, legislature, and the judiciary through the activities of which artificial, engineered, and factored breaches of contract are made, judgments are obtained, appeals are delayed, and the penalty imposed is paid and shared,” the statement read. “Nigerians need to pity their own country for the way things were done in the past.”

A spokeswoman for P&ID said the panel of arbitrators had heard evidence from both sides and ruled unanimously that Nigeria failed to uphold its contractual commitments and was liable to P&ID. “It is unfortunate that instead of accepting the tribunal judgment and engaging in good-faith discussions to bring about a solution, President Buhari’s government has resorted to spreading unfounded allegations,” she said. She described the justice department’s corruption probe as a “sham” and said the government’s allegations were “entirely fictional,” adding, “The Nigerian people would be better served if the government made a serious offer to resolve this dispute rather than only blaming others, which will not make the legal obligation to pay go away.”

The list of Nigerians skeptical of P&ID’s position includes Danjuma, the 81-year-old billionaire and former general.

In an interview with Businessweek, he said the gas flaring project was originally his idea, and that one of his companies, Tita-Kuru Petrochemicals Ltd., had spent the $40 million preparing it, not Quinn. The Irishman had been a consultant, using Danjuma’s funds and office space, the general said. When Quinn applied for the contract himself, Danjuma was upset.

The realization dawned, he said, that “my consultant was going to steal my project.” He recalled being promised a share of P&ID in return for his initial investment, but added that he hadn’t heard from the company in years and that Cahill hadn’t replied to letters about the lawsuit. At one point, Danjuma dusted off his hands to emphasize the relationship’s end. P&ID’s spokesperson declined to comment on Danjuma’s involvement or any other matters raised in this story. Cahill didn’t respond to attempts to contact him directly.

Lights Out

At Quinn’s funeral in February 2015, they played The Lonesome Boatman, a flute ballad by the Fureys, one of the bands he’d managed in his youth. His obituary in the Irish Independent traced his love of Nigeria to those days, saying he’d found doing business there much like running show bands in the ’60s. “He was a clever guy, an honorable guy,” Murray said of his longtime friend. “He was trusted. How much money he made I don’t know. His house is a hell of a lot bigger than mine.”

In spite of Buhari’s comments and the criminal probe, Nigeria hasn’t made any formal allegations of misconduct, and it isn’t clear whether the country will challenge the deal’s legitimacy in court. Meanwhile, the $9 billion debt is growing by more than $1 million a day, because of interest. P&ID is now owed enough to fund Nigeria’s school system for seven years.

Or perhaps enough to eliminate flaring for good. In May an Abuja TV news program aired a segment about villagers who were using flames from the Niger Delta’s gas pipes to dry their fish, seemingly unaware of the health risks. “Communities don’t know the difference between day and night because they go to bed with active gas flare sites,” said Faith Nwadishi, a local activist. The show’s host was just beginning a sermon about electricity’s importance for economic development when a power outage struck, plunging central Abuja into darkness.

—With Tope Alake, Matthew Campbell, Gavin Finch, Daryna Krasnolutska, the International Consortium of Investigative Journalists, and Süddeutsche Zeitung