IMPI Revises Inflation Rate Projection To 14% From 17% For December

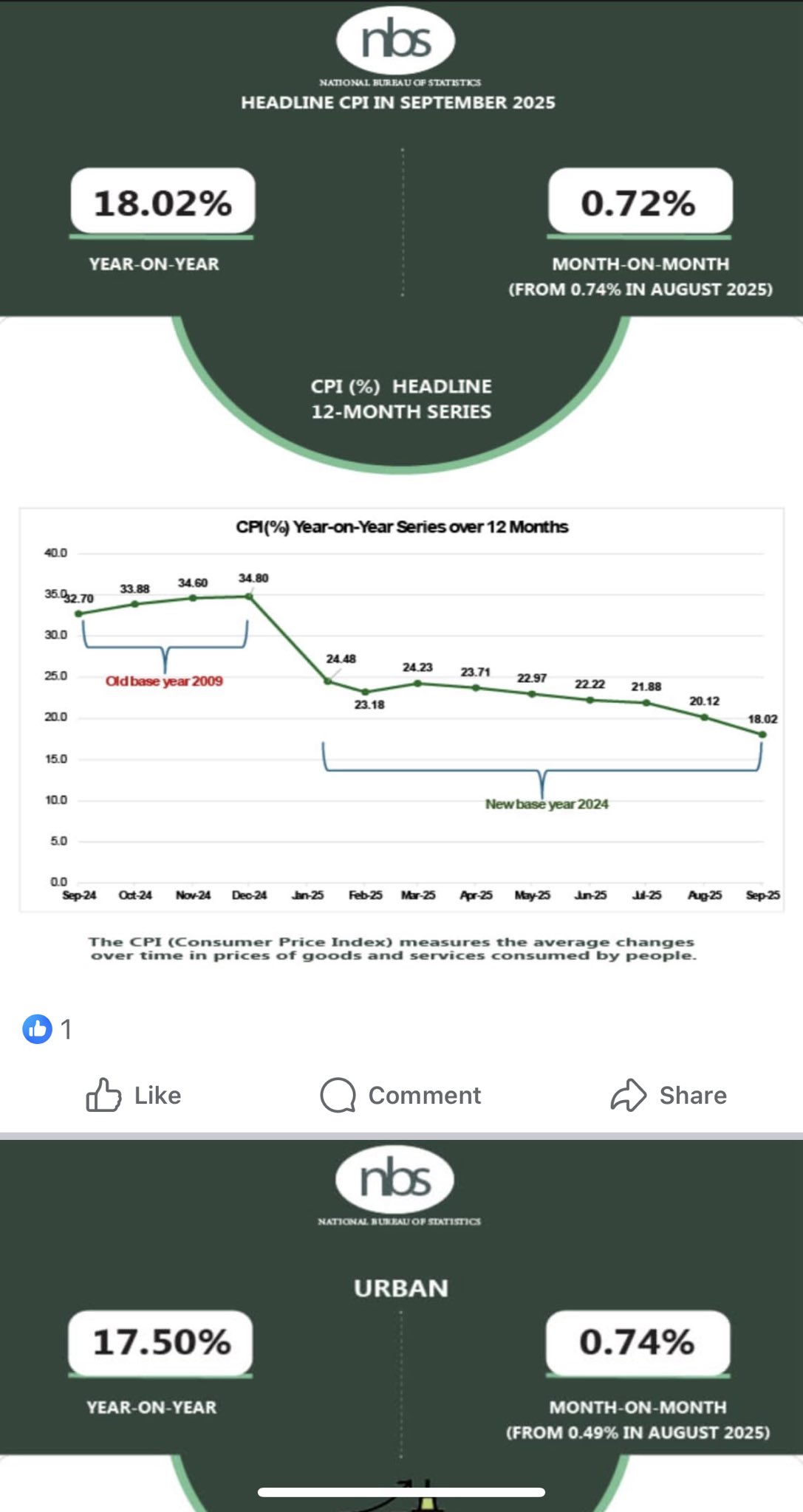

The Independent Media and Policy Initiative (IMPI) is projecting that headline inflation will drop further to 14 percent before the end of the year in the aftermath of the recent decline to 18.02 percent.

The think tank, had in its September Policy Statement 029, projected that Nigeria’s inflation rate will trend down to 17 percent from the 20.12 percent recorded in August 2025.

It turned out that Inflation data released by the National Bureau of Statistics was near the 17 percent projected by IMPI.

In a policy statement signed by its Chairman, Dr Omoniyi Akinsiju, IMPI noted that the drop in inflation in the last six months would have had some impact on the current poverty data.

It said: “In many particular ways, inflation plays a significant role in the World Bank’s template of increased estimates of poverty in a jurisdiction. In a period of persistent increase in prices, the correlation is that more people within that jurisdiction are expected to slide or fall into poverty because of the erosion of purchasing power and the inability of an increasing percentage of the people to afford basic economic sustenance items, especially food and energy.

”Thus, the high inflation environment that prevailed in Nigeria, peaking at 34.8 percent in December 2024, was a major input to the estimated 139 million Nigerians falling into poverty by the World Bank.

”Things have, however, changed over the last six months. From the high inflationary environment, the economy has transmuted to a vastly improved one. Now, we can safely assert that more Nigerians have been cycled out of poverty, which is consequent to the ongoing disinflation in the economic space.”

”With a new set of data available to us, we can further improve on our Consumer Price Index (CPI) projection to submit that the inflation rate will decline to 14 percent by December 2025. This is a shift from the 17 percent we projected in our last Policy Statement. We continue to observe a strong determination by the federal administration to ensure a low-cost economic environment, even as it grapples with labour disputes on multiple fronts.

The think tank also expects the Central Bank to reduce the benchmark interest rate by at least 150 basis points during its next Monetary Policy Committee (MPC).

”Also associated with that projection was the possible reduction of the all-important Monetary Policy Rate (MPR), which, in our last Policy Statement, we projected to be reduced by a total of 200 basis points to 25.50 per cent. We still expect that the Monetary Policy authorities, the Central Bank of Nigeria, will, at its next meeting, have compelling reasons to, at the least, reduce the MPR by another 150 basis points,” it added.