Redesigning Of Naira: CBN Only Needs The President’s Approval – Prof Moghalu

Posted on October 30, 2022

MICHAEL AKINOLA

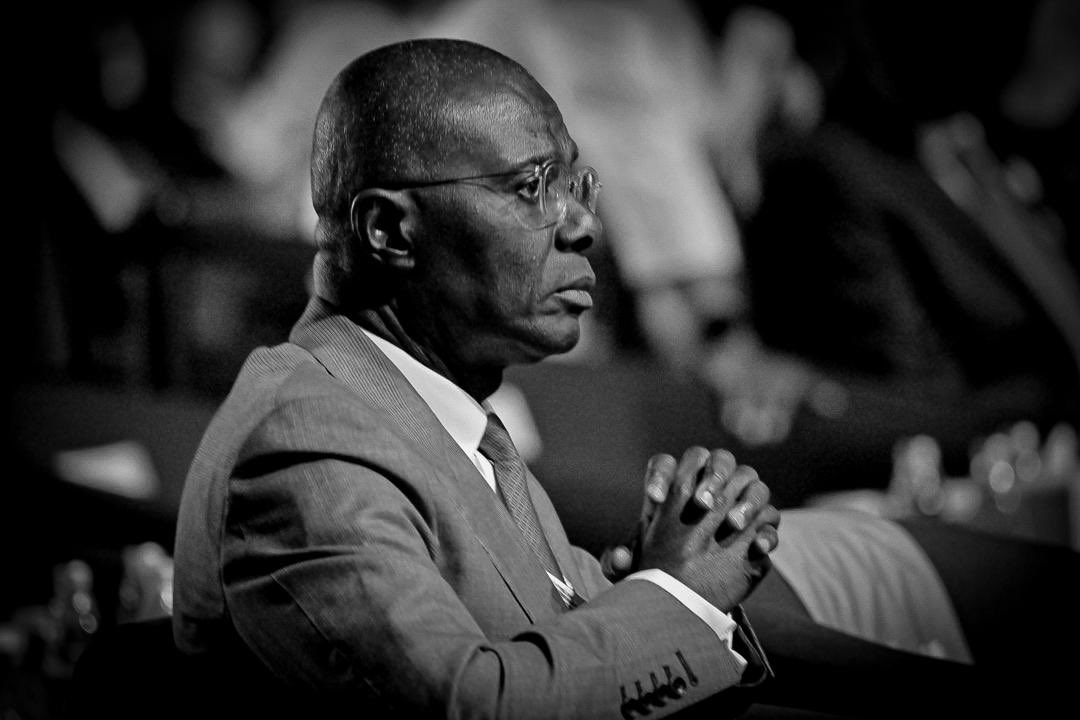

Following comment by the Honourable Minister of Finance, Zainab Ahmed, on the redesigning of the Nigeria’s currency, Naira, the former Deputy Governor of Central Bank of Nigeria, Prof Kingsley Moghalu, has said that Apex Bank, CBN, only needs the approval of President Muhammadu Buhari according to the CBN Act of 2007.

Making the clarification, Prof Moghalu said, “Finance Minister, Zainab Ahmed’s comment to the Senate that she was not aware of the Naira redesign by the Central Bank of Nigeria should not mislead anyone into thinking the CBN owes her that kind of information. The Bank only needs the approval of President Muhammadu Buhari for this particular exercise”.

“It received that approval. There are only three issues on which, in the CBN Act of 2007, the Bank should obtain external authorization, and only from the President of Nigeria, for its operations: 1. Any alterations to the legal tender (the Naira); 2. any investment of the Bank’s funds outside Nigeria; 3. the Bank’s annual report.”

“Outside of these, the only approving authorities for CBN operations are its Committee of Governors (note the “s”) consisting of the Governor and the four Deputy Governors, and the Board of Directors of the CBN, which includes the Governor, the four Deputy Governors, and 7 external members, which include the Permanent Secretary of the Federal Ministry of Finance and the Accountant-General of the Federation.”

“My criticism of the current Governor of the Bank in the past is that he has politicized the Central Bank by routinely subjecting its operations to the whims and caprices of the Presidency far beyond what is the appropriate relationship, and compromised the independence of the CBN as a result. That is why the Finance Minister erroneously feels entitled to be informed or consulted.”

“The CBN should now focus hard on the implementation of this policy. It will impose huge pressures on the banking system as I have said in another comment. How can the woman frying akara in the rural areas, who keeps most of her cash under her pillow, be aided to come into the banking system under this new policy? There are others as well, whose money is outside the banking system for reasons that are not negative.”